Prescription Drug Price Discrimination

in the 5th Congressional District in Florida

Drug Manufacturer Prices Are Higher for

Humans than for Animals

______________________________________________________________________________

Prepared for Rep. Karen L. Thurman

Minority Staff

Special Investigations Division

Committee on Government Reform

U.S. House of Representatives

March 16, 2000

Table of

Contents

Executive

Summary

I. The

Impact of High Drug Prices

II.

Objective of the Study

III.

Methodology

A.

Selection of Drugs

1.

Popular Drugs

2.

Directly Comparable Drugs

B.

Determination of Manufacturer-Level Prices for Humans

C.

Determination of Manufacturer-Level Prices for Animals

D.

Comparison of Manufacturer-Level Prices

E.

Evaluation of Impacts on Uninsured Consumers

IV.

Results of Price Comparisons

A.

Manufacturer Prices Are Over Twice as High for Humans as for Animals

1.

Price Differentials for Popular Prescription Drugs

2.

Price Differentials for Directly Comparable Prescription Drugs

B.

Price Differentials Can Be Substantial in Dollar Terms

C.

Retail-Level Price Differentials Between Human and Animal Drugs Can Be

Significant

V. Drug Prices for Uninsured Consumers in the

5th Congressional District in

Florida Could Be Significantly Reduced by

Preventing Price Discrimination

VI. Quality

Differences and Research Costs Do Not Appear to Explain The Price

Differentials

A.

Drug Quality and Production Cost

B.

Research and Development Costs

VII.

Conclusion

Appendices

EXECUTIVE

SUMMARY

This report on prescription drug pricing was

prepared at the request of Karen L. Thurman,

who represents the 5th Congressional

District in Florida. Rep.

Thurman asked the minority staff of the

Committee on Government Reform to investigate two important questions relating

to the pricing of human and animal drugs: (1) whether drug manufacturers who

sell the same drug for both human use and animal use charge different prices for

human use than for animal use; and (2) if the manufacturers are charging

different prices, what impacts these pricing practices have on drug costs for

consumers in Rep. Thurman's district.

The report finds that drug manufacturers are

engaging in substantial price discrimination, charging low prices for drugs when

they are used by animals and high prices for the same drugs when they are used

by seniors and other consumers who pay for their own drugs. The report also

finds that drug prices for uninsured consumers in the 5th Congressional District in Florida could be significantly reduced if drug manufacturers

eliminated this price discrimination.

This report investigates drug pricing at the

manufacturer level. Its focus is the prices that drug manufacturers charge

wholesalers of human and animal drugs rather than the prices that wholesalers

charge pharmacists and veterinarians or the prices that pharmacists and

veterinarians charge individual consumers. Because most animal drugs are

purchased from veterinarians (who both prescribe and dispense medications) and

not from pharmacists (who only dispense medications), the human and animal drug

markets have substantially different characteristics at the retail level.

Although retail-level price comparisons are analyzed in one part of this report,

differences between the human and animal drug markets at the retail level make

the two markets less comparable at the retail level than at the manufacturer

level.

A. Methodology

Many drugs that are approved and sold for human

use are also approved and sold for animal use. Under the applicable FDA

regulations, both the human and animal versions of the drugs must meet the same

standards for quality and purity. This report investigates the pricing of two

groups of drugs that are approved for both human and animal use. The animals

that use these drugs include cattle, horses, dogs, and cats.

First, the report analyzes the pricing of

popular brand name prescription drugs that are used by both humans and animals.

These are drugs that meet the following criteria: (1) they are among the 200

most popular prescription drugs used by humans during 1998; (2) they are

approved by FDA for both human and animal use; (3) they are dispensed to humans

and animals for consumption through the same dosage route; and (4) they are

commonly available by out-patient prescription. Eight drugs meet these

criteria.

Among these eight popular drugs, some are sold

in a different dosage to humans than animals, and several are made by different

manufacturers for the human and animal markets. To determine if these factors

affected the findings, the report analyzes a second group of drugs that are

directly comparable in their human and animal versions. The drugs in the second

group are brand name drugs that meet the following criteria: (1) they are

approved by FDA for both human and animal use; (2) they are dispensed to humans

and animals in the same dosage for consumption through the same dosage route;

(3) they are manufactured for human and animal use by the same (or related)

companies; and (4) they are commonly available for human use by out-patient

prescription. Eight drugs also meet these criteria. Two of these eight drugs -

Lodine and Vasotec - are also in the first group of popular drugs.

B. Findings

Drug manufacturers charge substantially

more for popular drugs when the drugs are used by humans than when the drugs are

used by animals. Eight brand name drugs among the top 200 are taken

through the same dosage route by both humans and animals and are commonly

obtained via out-patient prescription. For these eight popular drugs, drug

manufacturers charge an average of 106% to 151% more when the drug is intended

for human use than when the drug is intended for animal use. This means that the

average manufacturer-level price for human use is more than twice as much as the

manufacturer-level price for animal use.

Drug manufacturers charge substantially

more for directly comparable drugs when the drugs are used by humans than when

the drugs are used by animals. Similar results were obtained when the

report examined the pricing of the eight brand name drugs that are made for the

human and animal markets in the same dosages by the same (or related) companies.

For this group of eight directly comparable drugs, manufacturers charge an

average of 131% more when the drug is intended for human use than when the drug

is intended for animal use. This price differential is similar to the price

differential observed for the eight popular drugs.

In dollar terms, the price differential

can be substantial. The drug with the largest price differential in

dollar terms is Lodine, a popular arthritis medicine used by both humans and

dogs. American Home Products charges $108.90 for a one-month supply of Lodine

when the drug is to be used by humans, but only $37.80 when the drug is to be

used by dogs. Another drug with a large price difference is Vasotec, a high

blood pressure medication that was the 14th most frequently prescribed human

drug in the United States in 1998. Merck charges $78.55 for a one-month supply

when the drug is to be used by humans, but only $51.30 when the drug is to be

used by dogs - an annual difference of over $325.

Drug prices for uninsured consumers in the

5th Congressional District in Florida could

be significantly reduced by preventing price discrimination. Based on a survey of pharmacists in Rep.

Thurman's district, the report calculates an

upper-bound estimate of the potential savings to individuals who must pay for

their own drugs, such as senior citizens without prescription drug coverage,

from eliminating price discrimination. If the eight popular drugs analyzed in

this report were sold by manufacturers at the same prices for human use that

they are currently sold for animal use, the prices of these drugs for uninsured

consumers in the 5th Congressional District

in Florida could be reduced by an average of

24% to 37%.

The price differentials cannot be

adequately explained by quality differences or research costs. The price

differentials observed in this report appear to be directly attributable to the

deliberate pricing strategies of the drug manufacturers. The report analyzes

whether differences in drug quality, drug production costs, or research and

development expenses are likely causes of the price differentials. None of these

factors appears to account adequately for the discriminatory pricing practices

found in the report.

I. THE IMPACT OF HIGH

DRUG PRICES

Prescription drug costs are rising and causing

increasing hardship for consumers who must pay for their own drugs. In 1990,

prescription drug expenditures in the United States were $37.7 billion

dollars.(1)

By 1998, prescription drug expenditures had more than doubled to $93.4 billion,

due to a combination of price increases and increased utilization.(2)

From 1992 to 1997, prescription drug expenditures rose by more than 11%

annually.(3)

Reducing the costs of prescription drugs has become a national issue, with

numerous proposals pending in Congress.

Much of the discussion of this issue has focused

on the plight of senior citizens, who make up 12% of the population, but use

one-third of all prescription drugs.(4)

Although the elderly have the greatest need for prescription drugs, they often

have the most inadequate insurance coverage for drugs. With the exception of

drugs administered during inpatient hospital stays, Medicare generally does not

cover prescription drugs. According to a recent analysis by the National

Economic Council, approximately 75% of Medicare beneficiaries lack dependable,

private-sector prescription drug coverage.(5)

A recent study by federal researchers found that 32% of Medicare recipients -

over 10 million seniors - do not have any insurance coverage for prescription

drugs.(6)

Because of the high costs of prescription drugs,

uninsured consumers in general - and seniors in particular - face enormous

hardships paying for the medications they need. A recent study found that

prescription drug expenditures are the single largest out-of-pocket health care

cost for senior citizens on Medicare.(7)

Approximately 4.5 million senior citizens spend over $1,000 annually on

prescription drugs, a significant burden for individuals living on a fixed

income.(8)

Indeed, one study found that more than one in eight seniors are forced to choose

between buying food and paying for prescription drugs.(9)

As a consequence of high drug prices, millions of senior citizens and other

uninsured consumers must go without necessary medications, skip doses, or take

less than their prescribed doses, thereby endangering their health.(10)

II. OBJECTIVE OF THE

STUDY

One of the root causes of high drug prices is

manufacturer price discrimination. In 1998, the Congressional Budget Office

(CBO) conducted a detailed examination of drug pricing. CBO found that drug

manufacturers engage in price discrimination that forces uninsured consumers to

pay the highest prices for drugs. According to CBO:

Different buyers pay different prices for

brand-name prescription drugs. . . . In today's market for outpatient drugs,

purchasers that have no insurance coverage for drugs . . . pay the highest

prices for brand name drugs.(11)

In March 1999, the Federal Trade Commission

(FTC) released a comprehensive analysis of prescription drug pricing that

reached a similar conclusion. As in the CBO study, the FTC study found that drug

manufacturers engage in price discrimination. According to the FTC:

A notable example of differential pricing is the

so-called "two tiered pricing structure" under which pharmaceutical companies

set lower prices to large buyers like hospitals, HMOs, and PBMs, and charge

higher prices to other buyers that include the uninsured and independent and

chain retail pharmacies.(12)

While these and other independent experts have

concluded that drug manufacturers engage in price discrimination, there have

been few analyses that quantify the extent of this discrimination. The first two

reports to quantify the extent of this price discrimination in

Florida's 5th congressional district were released by Rep.

Thurman. These reports showed that (1)

uninsured senior citizens in the 5th

Congressional District in Florida pay over

twice as much for prescription drugs as favored customers like HMOs and the

federal government,(13)

and that (2) uninsured senior citizens in Florida's 5th congressional district also pay far higher prices than

do purchasers in Canada and Mexico.(14)

This study seeks to quantify the extent of price

discrimination in a third way. It compares the prices that drug manufacturers

charge for drugs used by humans with the prices that the manufacturers charge

for the same drugs when used by animals. It is the first study to estimate the

effect of this type of price discrimination on drug costs for uninsured

consumers in Rep. Thurman's congressional

district in Florida, such as senior citizens

who pay for their own drugs.

III.

METHODOLOGY

A. Selection of

Drugs

Approximately 37,000 prescription drug products

in the United States are approved for human consumption.(15)

These 37,000 drugs contain approximately 2,500 different active

ingredients.(16)

In 1998, drug manufacturers sold almost $100 billion worth of these

pharmaceuticals for use in the United States.(17)

The animal drug market is smaller, but is

growing rapidly. Over 1,500 drug products in the United States are approved for

animal consumption.(18)

These drugs contain approximately 400 different active ingredients.(19)

Drug manufacturers are continuing to seek approval for new drugs for the animal

market, particularly for companion animals.(20)

In 1998, drug manufacturers sold approximately $3.1 billion worth of

pharmaceuticals for animal use.(21)

There is a substantial overlap between drugs

approved for human and animal use. Of the approximately 400 active ingredients

found in animal drugs, approximately 80 are approved by the Food and Drug

Administration for use by both humans and animals. In total, about 400 animal

drugs contain active ingredients that are also found in human drugs. In

many other cases, veterinarians prescribe products that are approved for human

use for use in animals.(22)

This study analyzed two sets of brand name

drugs. The first set of drugs is comprised of popular brand name drugs that are

manufactured for both human and animal use. The second set of drugs is comprised

of brand name drugs that are directly comparable in their human and animal

versions.(23)

1. Popular

Drugs

The first set of drugs

analyzed in this report are brand name drugs that meet the following criteria:

(1) the drug is among the 200 most popular drugs used by humans during 1998; (2)

the drug is approved by FDA for both human and animal use; (3) the drug is

dispensed to humans and animals for consumption through the same dosage

route;(24)

and (4) the drug is commonly available for human use by out-patient

prescription. Drug popularity was determined based on the 1998 listings by

Pharmacy Times of (1) the top 200 drugs ranked by dollar sales and (2)

the top 200 drugs ranked by number of prescriptions filled.(25)

Any drug on either list was considered to be one of the top 200 drugs used by

humans in 1998.

The following eight drugs meet these four

criteria:

- Amoxil, which is manufactured by SmithKline

Beecham for sale to the human market and by A.H. Robbins for sale to the

animal market under the brand name Robamox. Amoxil is an antibiotic and was

the 45th most frequently prescribed human drug in the United States in 1998.

The product is approved on the animal market as an antibiotic to treat dogs

and cats.

- Augmentin, which is manufactured by

SmithKline Beecham for sale to the human market and by Pfizer for sale to the

animal market under the brand name Clavamox. Augmentin is an antibiotic and

was the 12th best selling human drug in dollar sales in the United States in

1998. The product is approved on the animal market as an antibiotic to treat

dogs and cats.

- Bactroban, which is manufactured by

SmithKline Beecham for sale to the human market and by Pfizer for sale to the

animal market under the brand name Bactoderm. Bactroban is a topical

antibiotic and was the 121st most frequently prescribed human drug in the

United States in 1998. The product is approved on the animal market to treat

infections in dogs.

- Lanoxin, which is manufactured by Glaxo

Wellcome for sale to the human market and by Evsco for sale to the animal

market under the brand name Cardoxin LS. Lanoxin is used to treat heart

failure in humans and was the 9th most frequently prescribed human drug in the

United States in 1998. The product is approved on the animal market to treat

heart failure in dogs.

- Lasix, which is manufactured by

Hoechst-Marion Roussel. Lasix is used to treat high blood pressure and heart

problems in humans and was the 160th most frequently prescribed human drug in

the United States in 1998. The product is approved on the animal market to

treat edema in cattle, dogs, and cats.

- Lodine, which is manufactured by

Wyeth-Ayerst, a subsidiary of American Home Products, for sale to the human

market and by Fort Dodge, another subsidiary of American Home Products, for

sale to the animal market under the brand name Etogesic. Lodine is used to

treat arthritis in humans and was the 143rd best selling human drug in dollar

sales in the United States in 1998. The product is approved on the animal

market to treat arthritis in dogs.

- Stadol, which is manufactured by

Bristol-Myers Squibb for sale to the human market and by a subsidiary of

American Home Products for sale to the animal market under the brand names

Torbutrol and Torbugesic. Stadol is used as a pain reliever in humans and was

the 195th best selling human drug in dollar sales in the United States in

1998. The product is approved on the animal market as a pain reliever in dogs

and horses.

- Vasotec, which is manufactured by Merck for

sale to the human market and by Merial, a subsidiary, for sale to the animal

market under the brand name Enacard. Vasotec is used to treat high blood

pressure in humans and was the 14th most frequently prescribed human drug in

the United States in 1998. The product is approved on the animal market to

treat heart failure in dogs.

2. Directly

Comparable Drugs

Among the eight popular drugs, three (Lasix,

Amoxil, and Bactroban) are manufactured in different dosages for the two

markets.(26)

In addition, five drugs (Amoxil, Augment, Bactroban, Lanoxin, and Stadol) are

made by different manufacturers for the two markets. In order to determine if

these factors account for the observed price differentials, a second group of

brand name drugs that are directly comparable in their human and animal versions

was also analyzed in this report. These drugs were chosen based on the following

criteria: (1) the drug is approved by FDA for use in both humans and animals;

(2) the drug is dispensed to humans and animals in the same dosage for

consumption through the same dosage route; (3) the drug is manufactured by the

same company (or by affiliates, subsidiaries, or partners of the same company)

for both the human and animal markets; and (4) the drug is commonly available

for human use by out-patient prescription.

Eight drugs meet these four criteria. Two of

these eight - Lodine and Vasotec - are also included in the list of popular

drugs. The six additional drugs that meet the four criteria are:

- Cleocin, which is manufactured by Pharmacia

and Upjohn and sold in the animal market under the brand name Antirobe.

Cleocin is an antibiotic used to treat bacterial infections in humans. The

product is approved on the animal market to treat bacterial infections in

dogs.

- Fulvicin U/F, which is manufactured by

Schering Plough. Fulvicin U/F is antifungal agent used to treat infections of

the skin, hair, and scalp in humans. The product is approved on the animal

market as an antifungal medication in dogs and cats.

- Medrol, which is manufactured by Pharmacia

and Upjohn. Medrol is used to treat arthritis, allergies, and asthma in

humans. The product is approved on the animal market as an anti-inflammatory

medication in dogs and cats.

- Robaxin, which is manufactured by A.H.

Robins. Robaxin is used an anti-inflammatory pain reliever in humans. The

product is approved on the animal market for use as a pain reliever in dogs

and cats.

- Robinul, which is manufactured by A.H.

Robins. Robinul is used in treatment of peptic ulcers in humans. The product

is approved on the animal market as a pre-anaesthetic agent for use in dogs

and cats.

- Winstrol, which is manufactured by

Sanofi.(27)

Winstrol is used to treat end stage renal disease, anemia, angioedema, and

chronic weight loss following major surgery in humans. The product is approved

on the animal market to treat weight loss, debility, and other symptoms

associated with old age or trauma in dogs and cats.

B. Determination of Manufacturer-Level Prices for

Humans

This report calculates the prices that drug

manufacturers charge for human drugs based on the Wholesale Acquisition Cost

(WAC) that human drug wholesalers pay to acquire drugs for sale to pharmacists.

WAC prices represent the average price that drug manufacturers charge human drug

wholesalers for products that are intended for resale to pharmacists. WAC prices

do not include rebates or other forms of discounts that favored customers like

HMOs often receive.

The prices paid by pharmacists for drugs are

slightly higher than the prices charged by the drug manufacturers to

wholesalers, because the prices paid by pharmacists incorporate a markup by the

drug wholesaler. Typical wholesale markups are small, about 2% to 4% above

WAC.(28)

C.

Determination of Manufacturer-Level Prices for Animals

To determine the prices that drug manufacturers

charge for drugs used by animals, the minority staff obtained the prices that

animal drug wholesalers sell the drugs investigated in this report to

veterinarians. Staff obtained these prices for five major animal drug

wholesalers and determined an average price that animal drug wholesalers charge

veterinarians for each of the drugs. To determine the manufacturer-level price

for the drugs, these average wholesale-level prices were adjusted to eliminate

the effect of the markup charged by animal drug wholesalers.(29)

Two drugs of the drugs examined in this report

are not sold to veterinarians through animal drug wholesalers, but are purchased

by veterinarians directly from the drug manufacturer. The prices that the

manufacturer charges for these two drugs were obtained by the minority staff. No

adjustment was made to account for the effect of a wholesale markup since these

prices were already manufacturer-level prices.

D. Comparison of

Manufacturer-Level Prices

Drug selection for this analysis was based on

criteria that were designed to minimize the differences, if any, between the

human and animal versions of drugs being compared. All drugs in this analysis

are sold in the same dosage route to both the human and animal markets. Whenever

possible, the drug dosages that are analyzed are identical in both the human and

animal markets.(30)

This was the case with all of the drugs analyzed in this report except for

Lasix, Amoxil, and Bactroban. For these drugs, the closest dosage sizes

available in the two markets were chosen for comparison, and price comparisons

were based on costs per gram of active drug ingredient. The dosages used in this

study are shown in Appendices A and B.

Once a dosage size was selected, prices were

determined for the quantity of drug in a typical one month supply of the product

for human consumers. Information on typical quantities prescribed by physicians

was obtained from the Physicians Desk Reference or from the U.S.

Pharmacopeia Dispensing Information.

E. Evaluation

of Impacts on Uninsured Consumers

To determine the effect that manufacturer-level

price differentials could have on prices paid by uninsured consumers in the

5th Congressional District in Florida, the

minority staff and the staff of Rep. Thurman's congressional office conducted a

survey of twelve drug stores -- including both independent and chain stores --

in her district. Rep. Thurman represents the 5th Congressional District on the

western coast of Florida, which includes the cities of Gainesville, Inverness,

and New Port Richey.

III. RESULTS OF PRICE

COMPARISONS

A. Manufacturer

Prices Are Over Twice as High for Humans as for Animals

1. Price Differentials for Popular

Prescription Drugs

Eight brand name drugs among the top 200 human

drugs are approved for use through the same dosage route for both humans and

animals and are commonly obtained for human use via out-patient prescription.

For these eight popular drugs, drug manufacturers charge far more when the

intended end-users are humans than when the intended end-users are animals. The

average differential between the price at which the drugs are sold by

manufacturers for human use and the price at which the drugs are sold by

manufacturers for animal use is 106% to 151%. This means that drug manufacturers

charge more than twice as much for these drugs when sold for use by humans as

they charge when the drugs are sold for use by animals (Table 1).

| Table 1: Drug Manufacturers Charge More for

Popular Drugs Used by Humans than for the Same Drugs Used by

Animals. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Drug Name |

Manufacturer of Human

Version |

Human Use |

Manufacturer Price

(One Month Supply) |

Price

Differential |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Animal Market |

Human Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bactroban |

SmithKline Beecham |

Antibiotic |

$9.98 |

$31.56 |

216% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Augmentin |

SmithKline Beecham |

Antibiotic |

$18.00 |

$56.40 |

213% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lodine |

American Home Products |

Arthritis |

$37.80 |

$108.90 |

188% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stadol |

Bristol Myers Squibb |

Pain Relief |

$25.48 |

$61.11 |

140% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lasix |

Hoechst Marion Roussel |

High Blood Pressure |

$4.80 |

$9.60 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Vasotec |

Merck |

High Blood Pressure |

$51.30 |

$78.55 |

53% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lanoxin |

Glaxo Wellcome |

Heart Failure |

$6.36 |

$25.65 ($4.08) |

303% (-56%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amoxil |

SmithKline Beecham |

Antibiotic |

$16.20 |

$15.30 |

-6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average for Eight Drugs |

|

|

151% (106%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

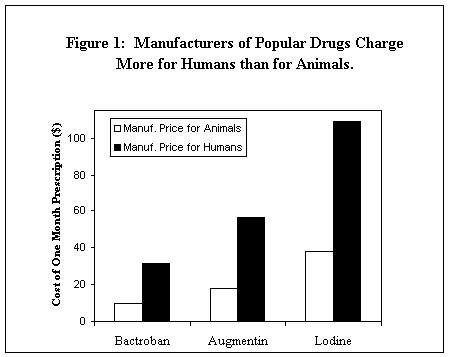

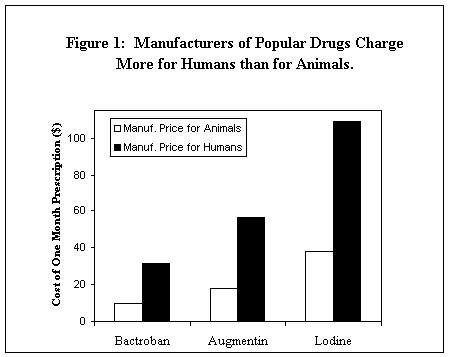

Three drugs with high price differentials in

percentage terms are Bactroban, Augmentin, and Lodine (Figure 1). Bactroban and

Augmentin, which are manufactured by SmithKline Beecham for the human market,

are both antibiotics. Both had price differentials of over 200%, which means

that the manufacturer-level price for these drugs is over three times more

expensive when the drug is intended for human use than when the drug is intended

for animal use.

Lodine is an arthritis medication. A common

prescription for Lodine is ninety 300 mg. capsules. Fort Dodge, a subsidiary of

American Home Products, sells this quantity of Lodine for only $37.80 when the

intended end-users are dogs or cats. But when the intended end-users are humans,

Wyeth-Ayerst, another subsidiary of American Home Products, sells the same

quantity of the drug for $108.90 -- a price differential of 188%.

Two different price differentials are presented

in this report for Lanoxin, a medication used to treat heart failure in both

humans and dogs. For the animal market, Lanoxin is manufactured in a liquid

form. For the human market, it is manufactured in both a liquid form and a

tablet form. For this drug, the most direct price comparison is a

liquid-to-liquid comparison between the manufacturer-level price for the liquid

version of the drug for animals ($6.36) and the manufacturer-level price for the

liquid version of the drug for humans ($25.65). This "apples to apples"

comparison results in a price differential of 303%, the highest price

differential in percentage terms among the popular drugs analyzed in this

report.

It is also possible, however, to compare the

price of the liquid version of the drug for animals with the price of the tablet

version for humans by calculating costs per gram of active drug ingredient.

Although this approach can be criticized as an "apples to oranges" comparison,

it is also included in this analysis in an effort to be conservative. The

manufacturer-level price for the human version of the same quantity of the drug

in tablet form ($4.08) is less than the manufacturer-level price of either the

liquid version of the drug for animals or the liquid version of the drug for

humans, producing a human to animal price differential of -56%.(31)

The only popular drug for which the

manufacturer-level price is less expensive for humans than for animals in a

direct "apples to apples" comparison is Amoxil. For this drug, which is

manufactured by SmithKline Beecham for the human market, the manufacturer-level

price is 6% lower for the human market than for the animal market.

- Price Differentials for Directly

Comparable Prescription Drugs

This report found similar results when analyzing the

pricing of directly comparable drugs: manufacturers charge significantly more

for directly comparable brand name drugs when the drugs are used by humans than

when the drugs are used by animals. There are eight brand name drugs that are

approved for use in the same dosage in both humans and animals, are manufactured

for both markets by the same (or related) companies, and are commonly obtained

for human use via out-patient prescription. For these eight products, the

average differential between the price at which the drug is sold by the

manufacturer for human use and the price at which the drug is sold by the

manufacturer for animal use is 131% (Table 2). This price differential is

similar to the average price differential observed for the eight popular drugs.

For both sets of drugs, manufacturers charge an average of more than twice as

much when a drug is sold for use by humans than they charge when the same drug

is sold for use by animals.

Among the directly comparable drugs, Medrol,

which is manufactured by Pharmacia and Upjohn, has the highest price

differential: 415%. This drug is used to treat arthritis, asthma, and allergies

in humans and is used as an anti-inflammatory agent in dogs and cats. Pharmacia

and Upjohn charges $20.10 for a one month supply of Medrol when the end-user is

a person seeking treatment for arthritis, but only $3.90 for the same quantity

of Medrol when the end-user is a dog. Winstrol, which is manufactured by Sanofi,

has the second highest price differential: 256%. This drug is used to treat

end-stage renal disease and anemia in humans and weight loss, debility, and

other symptoms associated with old age in dogs and cats. Sanofi sells this drug

for $19.20 when the end-users are humans, but only $5.40 when the end-users are

animals.

| Table 2: Drug Manufacturers Charge More for Directly

Comparable Drugs When the Drugs Are Used by Humans than When the Drugs Are

Used by Animals. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Drug Name |

Manufacturer |

Human Use |

Manufacturer Price

(Monthly Supply) |

Price Differential |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Animal Market |

Human Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Medrol |

Pharmacia and Upjohn |

Arthritis; Allergies; Asthma |

$3.90 |

$20.10 |

415% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Winstrol |

Sanofi |

Anemia; Renal Disease |

$5.40 |

$19.20 |

256% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lodine |

American Home Products |

Arthritis |

$37.80 |

$108.90 |

188% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Robaxin |

A.H. Robins |

Pain Relief |

$15.00 |

$31.20 |

108% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Vasotec |

Merck/Merial |

High Blood Pressure |

$51.30 |

$78.55 |

53% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cleocin |

Pharmacia and Upjohn |

Antibiotic |

$17.10 |

$22.20 |

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Robinul |

A.H. Robins |

Ulcers |

$29.40 |

$29.98 |

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fulvicin U/F |

Schering |

Antifungal |

$38.40 |

$36.60 |

-5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average for Eight Drugs |

|

|

131% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Overall, manufacturers charge more for seven of the eight

directly comparable drugs when the end users are humans than they charge when

the end users are animals. The only drug that was less expensive at the

manufacturer-level for humans than for animals was Fulvicin U/F, which is

manufactured by Schering.

B.

Price Differentials Can Be Substantial in Dollar Terms

These price differences can translate into large

differences in dollar terms. Two of the drugs surveyed in this report, Lodine

and Vasotec, are both popular (among the top 200 human drugs in 1998) and

directly comparable (manufactured in the same dosage route and dosage by the

same or related companies in both the human and animal markets). Both have large

price differentials in dollar terms.

Lodine, the arthritis medication made by

subsidiaries of American Home Products, has the largest price differential in

dollar terms observed in this report. The manufacturer sells a monthly

prescription of this drug for $108.90 for human use -- more than $70 more than

the manufacturer charges when selling the same quantity of the drug for use by

dogs or cats.

Similarly, Vasotec, the 14th most prescribed

human drug in 1998, has a large dollar value price differential. Merck sells a

one-month supply of Vasotec for $78.55 when the intended users are human, while

Merial, a Merck subsidiary, charges only $51.30 - over $25 less - when the

intended users are animals. Vasotec treats a chronic condition (high blood

pressure) and is often taken over long periods by senior citizens and others. On

an annual basis, the manufacturer-level price differential for Vasotec is over

$325.

C.

Retail-Level Price Differentials Between Human and Animal DrugsCan Be

Significant

This analysis focuses primarily on the prices

that drug manufacturers charge wholesalers of human and animal drugs, not the

prices that wholesalers charge pharmacists and veterinarians or the prices that

pharmacists and veterinarians charge individual consumers. In the case of

comparisons of human and animal drugs, a manufacturer-level price comparison

provides a more direct comparison than a retail-level price comparison because

of the differing nature of the retail market for human and animal drugs. Human

drugs are prescribed by a doctor and dispensed by a pharmacist. In contrast,

most animal drugs are both prescribed and dispensed by the veterinarian. Because

they serve both functions, veterinarians often incorporate some of the costs of

practicing veterinary medicine into their prices for prescription drugs,

resulting in markups that are many times higher than pharmacists charge.

Because of these complexities, the most direct

comparison of retail-level prices can be obtained by comparing the prices that

pharmacists charge human consumers with the prices that specialized veterinary

pharmacies charge animal owners. Through the Internet and mail order, the

minority staff identified three veterinary pharmacies that resemble human

pharmacies in that they dispense, but do not prescribe, medications.(32)

These veterinary pharmacies sell seven of the eight popular drugs investigated

in this report. The report compared the average prices that these veterinary

pharmacies charge for the drugs with the average retail prices that consumers in

Rep. Thurman's district must pay for the same drugs.

This analysis showed that there is a substantial

difference between what consumers in Florida must pay for these seven drugs and

the prices that animal owners can pay to acquire the drugs from veterinary

pharmacies.(33)

On average, it costs consumers in the 5th Congressional District in

Florida107% to 198% more for these drugs than animal owners (Table 3). This

means that uninsured consumers in Rep. Thurman's district, such as senior

citizens without prescription drug coverage, are being forced to pay on average

two to three times as much as animal owners to acquire these drugs.

| Table 3: Retail-Level Prices Are More Expensive for Human

Consumers in Rep. Thurman's District than for Animal Owners. |

|

|

|

|

| Drug |

Average Retail

Price

(Monthly Supply) |

Price Differential

(%) |

|

Price at Veterinary

Pharmacy |

Retail Price for

Humans |

|

|

|

|

|

| Bactroban |

$14.50 |

$47.80 |

230% |

| Augmentin |

$25.84 |

$80.53 |

212% |

| Lasix |

$5.37 |

$15.72 |

193% |

| Lodine |

$65.25 |

$136.72 |

110% |

| Amoxil |

$15.29 |

$19.97 |

31% |

| Lanoxin |

$5.41 |

$38.43 ($4.39) |

610% (-23%) |

| Vasotec |

$91.41 |

$91.85 |

0% |

| Average Price Differential |

|

198% (107%) |

V. DRUG PRICES FOR UNINSURED

CONSUMERS IN THE 5TH CONGRESSIONAL DISTRICT IN FLORIDA COULD BE SIGNIFICANTLY

REDUCED BY PREVENTING PRICE DISCRIMINATION

The price comparisons described in part III show

that drug manufacturers charge different prices for drugs intended for human use

than for drugs intended for animal use. This part assesses the impact that this

manufacturer-level price discrimination has on human drug prices for consumers

in Rep. Thurman's district.

To make this assessment, the report estimates

the potential cost savings for consumers in the 5th Congressional District in

Florida if drug manufacturers did not engage in price discrimination and instead

charged the same price for human drugs that they now charge for animal drugs.

Experts state that drug wholesalers and retail pharmacies are highly competitive

and are likely to pass any cost savings on to consumers. According to Professor

Stephen W. Schondelmeyer, "[a]ny discounts passed on to community pharmacies

will be passed on to the consumer, or payor, of the prescription because of the

competitive retail environment."(34)

For this reason, the analysis assumes that the reductions in the

manufacturer-level price will be passed on to the pharmacist by the human drug

wholesaler and to the consumer by the pharmacist.

Under these circumstances, the potential savings

would be substantial for consumers in Rep. Thurman's district who purchase their

own drugs, such as senior citizens without prescription drug insurance. For

example, the average retail cost of purchasing a one month supply of the blood

pressure medication Vasotec in the 5th district is $91.85.

If this price were reduced by $27.25, which is the difference between the

manufacturer-level price for human use and the manufacturer-level price for

animal use, a consumer in the 5th district would pay only $64.60 for a one-month

supply. On an annual basis, the consumer in Rep. Thurman's district would save

over $325.

In dollar terms, consumers in Rep. Thurman's

district who purchase Lodine would realize the greatest savings. Their drug

costs would drop by over $70 for a one-month supply. Table 4 summarizes the

potential savings for each of the eight popular drugs analyzed in this report.

The average savings for the eight popular drugs would be 24% to 37%.

| Table 4: Consumers in Rep. Thurman's District Could Save

Hundreds of Dollars if Drug Manufacturers Did Not Engage in Price

Discrimination. |

|

|

|

|

| Drug |

Average

Retail Price

in the 5th

District

(Monthly

Supply) |

Potential

Savings

(Dollars) |

Potential

Savings

(%) |

|

|

|

|

| Lodine |

$136.72 |

$71.10 |

52% |

| Augmentin |

$80.53 |

$38.40 |

48% |

| Bactroban |

$47.80 |

$21.58 |

45% |

| Stadol |

$84.51 |

$35.63 |

42% |

| Lasix |

$15.72 |

$4.80 |

31% |

| Vasotec |

$91.85 |

$27.25 |

30% |

| Lanoxin |

$38.43

($4.39) |

$19.29

(-$2.28) |

50% (-52%) |

| Amoxil |

$19.97 |

-$0.90 |

-5% |

| Average

Savings |

37% (24%) |

These estimates of the potential savings for

uninsured consumers in Rep. Thurman's district should be considered upper-bound

estimates. The estimates assume that drug manufacturers sell their products to

human drug wholesalers at the same price that they are now selling their

products to animal drug wholesalers. In reality, drug manufacturers could choose

to sell to both markets at a price between their current animal and human

prices. Moreover, representatives of the drug manufacturers have argued that

pharmacists would not pass along all of the cost savings to uninsured consumers.

These factors could reduce the potential savings.

VI. QUALITY DIFFERENCES AND

RESEARCH COSTS DO NOT APPEAR TO EXPLAIN THE PRICE DIFFERENTIALS

This report examined several possible

explanations for the substantial manufacturer-level price differences observed

between the drugs intended for human use and the drugs intended for animal use.

The most probable explanation appears to be that price discrimination is a

central component of the drug manufacturers' pricing strategies.

A. Drug

Quality and Production Costs

It appears unlikely that differences in drug

quality can explain the results observed in this study. The Food and Drug

Administration regulations governing drug quality and production, the so-called

"good manufacturing practice" (GMP) requirements, are codified in 21 C.F.R. part

211. These requirements, which are designed to ensure drug quality and

consistency, apply equally to both human and animal drugs. According to

FDA:

The methods, facilities, and controls under

which animal drugs are manufactured, processed, packaged, or held for sale must

conform to the requirements of the regulations for Current Good Manufacturing

Practices in the drug industry generally.(35)

Differences in production costs are also

unlikely to be the cause of the high price differentials because production

costs are only a small part of the final cost of a prescription drug. The

typical marginal cost of manufacturing additional volumes of a medication has

been estimated to be only 5% of the retail cost.(36)

Thus, even large differences in drug production costs would be unlikely to

result in the differences in drug prices observed in this study.

B. Research and

Development Costs

Drug manufacturers frequently point to the costs

of research and development as a justification for high prices. However,

differences in research and development costs do not appear to explain the

differences in cost between identical human and animal drugs.

According to an industry expert consulted by the

minority staff, Dr. Alan Sager of the Boston University School of Public

Health:

The observed price differences cannot be

explained by differences in research costs. Research is a fixed or sunk cost.

Manufacturers do not set their prices based on recovery of these costs. Instead,

they set their prices as high as possible in order to maximize revenue and

profit.(37)

Moreover, according to industry analysts,

pharmaceutical manufacturers are "investing heavily" in research and development

of animal drugs.(38)

Relative to the size of the markets, drug manufacturers appear to spend

approximately as much on research and development of animal drugs as they do on

research and development of human drugs. Pfizer, an industry leader in animal

drug sales, had revenues of $1.3 billion from animal drugs in 1998, and spent

approximately $200 million - over 15% of total sales - on research of animal

drugs.(39)

Pfizer also spent approximately the same proportion of revenues, 17%, on its

drug products intended for sale to humans.(40)

The high research investment in animal drugs is

confirmed by the pharmaceutical industry, which states:

All animal health products go through a

stringent seven-step process that involves testing to discover a product,

testing to approve the product, and testing to monitor the product once it's

been approved....Bringing an animal health product to market is a complex

process. Only one in 20,000 discovered chemicals ever makes it from the

laboratory to the farm. And only one in 200 potential drugs makes it through

pre-clinical testing and approval.(41)

VI.

CONCLUSION

The findings in this report are consistent with

the results of the first drug pricing study done at Rep. Thurman's request. The

first study found that uninsured seniors in the 5th Congressional District in

Florida pay 112% more for the five most popular prescription drugs used by

seniors than favored purchasers such as HMOs and the federal government.(42)

When this study was updated in March 2000, the price differential between

seniors and favored purchasers increased to 125%.(43)

The second study found that uninsured seniors in the 5th Congressional District

in Florida pay 81% more for these prescription drugs than individual purchasers

in Canada, and 79% more than individual purchasers in Mexico.(44)

All three studies thus reach the same basic finding: drug manufacturers are

engaged in systematic price discrimination that adversely affects millions of

senior citizens and other consumers who lack prescription drug coverage.

Appendix A:

Information on Popular Prescription Drugs in this Survey

| Human Brand Name |

Animal Brand Name |

Tablet, Capsule, or Package

Size |

Average Manufacturer Charge

per Tablet, Capsule, or Package |

Average Manufacturer Charge

per Gram of Active Ingredient |

Typical One Month Prescription for

Humans |

Average Manuf. Charge for

Quantity of Active Ingredient in Typical One Month Human

Prescription |

|

|

|

Animal |

Human |

Animal |

Human |

|

Animal |

Human |

| Amoxil |

Robamox |

250 mg. cap. (human); 200 mg. cap. (animal) |

$0.14/cap. |

$0.17/cap. |

$0.70 |

$0.68 |

90 cap. |

$16.20 |

$15.30 |

| Augmentin |

Clavamox |

125 mg. tab. |

$0.30/tab. |

$0.94/tab. |

$2.40 |

$7.52 |

60 tab. |

$18.00 |

$56.40 |

| Bactroban |

Bactoderm |

2%, 30 gm. (human); 2%, 15 gm. (animal) |

$4.99/

15 gm. |

$31.56/

30 gm. |

$16.63 |

$52.60 |

30 gm. |

$9.98 |

$31.56 |

| Lanoxin (liquid)

Lanoxin (tab.) |

Cardoxin LS

NA |

50 g./ml., 2 oz.

0.125 mg. |

$6.36

NA |

$25.65

$0.17/tab. |

$2.12

NA |

$8.55

$1.36 |

3 gm. active ingredient

30 tab. |

$6.36

N/A |

$25.65

$5.10(45) |

| Lasix |

Lasix |

20 mg. tab. (human); 12.5 mg. tab. (animal) |

$0.05/cap. |

$0.16/cap. |

$8.00 |

$4.00 |

60 cap. |

$4.80 |

$9.60 |

| Lodine |

Etogesic |

300 mg. cap./tab. |

$0.42/tab. |

$1.21/cap. |

$1.40 |

$4.03 |

90 cap. |

$37.80 |

$108.90 |

| Stadol |

Torbugesic |

2 mg./ml., 10 ml. |

$25.48 |

$61.11 |

$1274.00 |

$3055.50 |

10 ml. |

$25.48 |

$61.11 |

| Vasotec |

Enacard |

5 mg. tab. |

$0.57/tab. |

$0.88/tab. |

$114.00 |

$176.00 |

90 tab. |

$51.30 |

$78.55 |

Appendix B: Information on

Directly Comparable Prescription Drugs in this Survey

| Human Brand Name |

Animal Brand Name |

Tablet or Capsule

Size |

Average Manufacturer Charge

per Capsule or Tablet |

Average Manufacturer Charge

Per Gram of Active Ingredient |

Typical One Month

Prescription

For Humans |

Average Manuf. Charge for

Quantity of Active Ingredient in Typical One Month Human

Prescription |

|

|

|

Animal |

Human |

Animal |

Human |

|

Animal |

Human |

| Cleocin |

Antirobe |

75 mg. |

$0.57 |

$0.74 |

$7.60 |

$9.87 |

30 cap. |

$17.10 |

$22.20 |

| Fulvicin U/F |

Fulvicin U/F |

500 mg. |

$1.28 |

$1.22 |

$2.56 |

$2.44 |

30 cap. |

$38.40 |

$36.60 |

| Lodine |

Etogesic |

300 mg. |

$0.42 |

$1.20 |

$1.40 |

$4.00 |

90 cap. |

$37.80 |

$108.90 |

| Medrol |

Medrol |

4 mg. |

$0.13 |

$0.67 |

$32.50 |

$167.50 |

30 tab. |

$3.90 |

$20.10 |

| Robaxin |

Robaxin |

500 mg. |

$0.25 |

$0.51 |

$0.50 |

$1.02 |

60 tab. |

$15.00 |

$31.20 |

| Robinul |

Robinul-V |

1 mg. |

$0.49 |

$0.50 |

$490.00 |

$500.00 |

60 tab. |

$29.40 |

$29.98 |

| Vasotec |

Enacard |

5 mg. |

$0.57 |

$0.87 |

$114.00 |

$174.00 |

90 tab. |

$51.30 |

$78.55 |

| Winstrol |

Winstrol-V |

2 mg. |

$0.18 |

$0.64 |

$90.00 |

$320.00 |

30 tab. |

$5.40 |

$19.20 |

1. Health Care Finance

Administration, National Health Expenditures (1999) (online at

www.hcfa.gov/stats/nhe-oact/tables/t10.htm).

2. National Institute for

Health Care Management Foundation, Factors Affecting the Growth of

Prescription Drug Expenditures (July 9, 1999).

3. National Health

Expenditures, supra note 1.

4. Senate Special Committee On

Aging, Developments in Aging: 1993, 103d Cong., 2d Sess. 35 (1994) (S.

Rpt. 403).

5. 5 National

Economic Council, Domestic Policy Council, Disturbing Truths and Dangerous

Trends: The Facts About Medicare Beneficiaries and Prescription Drug

Coverage (July 22, 1999). In this study, private sector retiree coverage was

considered to be the only dependable form of private-sector prescription drug

coverage for senior citizens. Other sources of coverage, such as Medigap

coverage or Medicare managed care plans were not considered dependable because

the plans are often expensive, inaccessible, or inadequate.

6. Health Affairs, Medicare

Beneficiaries and Drug Coverage, 252 (Mar./Apr. 2000).

7. AARP Public Policy

Institute, Out-of-Pocket Health Spending by Medicare Beneficiaries Age 65 and

Older: 1999 Projections (Dec. 1999).

8. See National Economic

Council, Domestic Policy Council, Disturbing Truths and Dangerous Trends: The

Facts About Medicare Beneficiaries and Prescription Drug Coverage,

supra note 5; Soumerai, Steven, Inadequate Prescription-Drug Coverage

for Medicare Enrollees - A Call to Action, New England Journal of Medicine

(Mar. 1999).

9. Families USA Foundation,

Worthless Promises: Drug Companies Keep Boosting Prices 6 (March

1995).

10. See Health Affairs,

Drug Coverage and Drug Purchases by Medicare Beneficiaries With

Hypertension, 219-230 (Mar./Apr. 2000).

11. Congressional Budget

Office, How Increased Competition from Generic Drugs Has Affected Prices and

Returns in the Pharmaceutical Industry, xi (July 1998).

12. Federal Trade Commission,

The Pharmaceutical Industry: A Discussion of Competitive and Antitrust Issues

in an Environment of Change, 75 (Mar. 1999).

13. Minority Staff Report of

the House Committee on Government Reform, Prescription Drug Pricing in the

5th Congressional District in

Florida: Drug Companies Profit at the

Expense of Older Americans (May 1999);

Minority Staff Report of the House Committee on Government Reform,

Prescription Drug Pricing in the 5th Congressional District in Florida: Drug Companies Profit at the Expense of Older

Americans (updated Mar. 2000).

14. Minority Staff Report of

the House Committee on Government Reform, Prescription Drug Pricing in the

5th Congressional District in

Florida: An International Price Comparison

(Aug. 1999).

15. FDA, Approved Drug

Products with Therapeutic Equivalence Evaluations (1999).

16. Id.

17. Factors Affecting the

Growth of Prescription Drug Expenditures, supra note 2.

18. FDA, FDA Approved

Animal Drug Products (1999).

19. Id.

20. See Tanouye, Elyse, Wall

Street Journal, The Ow in Bowwow: With Growing Market in Pet Drugs, Makers

Revamp Clinical Trials (Apr. 13, 1999).

21. Animal Health Institute,

Press Release: Animal Health Product Sales Rise to $4.3 Billion in 1998

(July 31, 1998).

22. For example, Prozac is

prescribed by some veterinarians to treat anxiety disorders in dogs. See The

Ow in Bowwow: With Growing Market in Pet Drugs, Makers Revamp Clinical

Trials, supra note 20. FDA regulations allow veterinarians to

prescribe a human-approved drug for animal use, provided that a product

containing the same active ingredient has not also been approved for use in

animals.

23. This report focused on

brand name drugs because manufacturers of brand name drugs generally have

greater control over drug pricing than manufacturers of less expensive generic

drugs. Several of the drugs included in the survey, however, are also available

in generic versions. Consumers who purchase these drugs in their generic version

are likely to pay less than those who purchase the brand name version. The

Congressional Budget Office has found that the availability of a generic drug

often does not decrease the cost of the brand name product. See How Increased

Competition from Generic Drugs Has Affected Prices and Returns in the

Pharmaceutical Industry, supra note 11.

24. Sometimes, the same drug

may be taken by humans and animals through different dosage routes. For example,

the drug may be taken orally by humans (through a tablet or capsule) and by

injection by animals. Only drugs that are taken through the same dosage route

are included in this analysis to increase the comparability of the drugs.

25. Pharmacy Times, The Top

200 Drugs of 1998 (1999) (online at

http://www.pharmacytimes.com/top200.html).

26. Lasix is sold in 20 mg.

tablets for the human market and in 12.5 mg. tablets for the animal market.

Amoxil is sold in 250 mg. capsules for the human market and 200 mg. capsules for

the animal market. Bactroban is sold in 30 gram tubes for the human market and

15 gram tubes for the animal market.

27. Although Winstrol is

manufactured by Sanofi, it is sold by Pharmacia and Upjohn on the animal market.

Pharmacia and Upjohn, Animal Health Products: Winstrol-V (1999) (online

at www.pnuanimalhealth.com/product/companimal/winstf2.html).

28. Patricia M. Danzon,

Price Comparisons for Pharmaceuticals: A Review of U.S. and Cross-National

Studies (April 1999).

29. The report adjusted for

the wholesale markup by reducing the average wholesale-level price by 3%. This

represents the midpoint of the markup that human wholesalers typically charge

pharmacies. See Price Comparisons for Pharmaceuticals: A Review of U.S. and

Cross-National Studies, supra note 28. Because the veterinary market

is smaller than the human market, it is possible that wholesalers of animal

drugs charge a higher markup than wholesalers of human drugs. If animal drug

wholesalers charge higher markups than human drug wholesalers, the actual

manufacturer-level prices for animal uses would be lower than the level reported

in this study. This would make the actual level of manufacturer price

discrimination higher than reported in this study.

30. In some cases, the drugs

analyzed in the report are sold in a range of different dosages on the human

market. For example, Lodine is sold for humans in dosages of 200, 300, 400, and

500 mg. In these cases, prices were compared based on the closest dosages

available in both the human and animal markets. In the case of Lodine, the drug

is only available in the 300 mg. dosage for animals. Thus, for purposes of the

price comparisons in this report, the price comparison is based on the 300 mg.

human version of Lodine.

31. A similar cost-per-gram

analysis comparing the price of the tablet form of a drug to the price of the

liquid form could also be done in the case of Lasix, which is sold in tablet

form for animals and in both tablet form and liquid form for humans. In the case

of Lasix, including this "apples to oranges" comparison would have the opposite

effect: it would substantially increase the price differential between the

animal and human versions of the drug. This analysis was not included in the

report.

32. The three veterinary pharmacists were KV Vet Supply,

Vet Warehouse, and Lambriar Animal Health.

33. Average retail prices for the tablet human version of

Lanoxin were not collected in Rep. Thurman's

district. As a substitute, the report uses the price at which the tablet version

of Lanoxin is available through a major Internet pharmacy. Generally, prices in

Rep. Thurman district are slightly higher

than prices available at this Internet pharmacy.

34. Schondelmeyer, Stephen W.,

PRIME Institute, University of Minnesota, Competition and Pricing

Issues in the Pharmaceutical Market, University of Minnesota, 12 (Aug.

1994).

35. U.S. Food and Drug

Administration, Requirements of Laws and Regulations Enforced by the U.S.

Food and Drug Administration (1999) (online at http://www.fda.gov/opacom/

morechoices/smallbusiness/blubook.htm#animalprod.html).

36. Alan Sager and Deborah

Socolar, Affordable Medications for Americans (July 27, 1999).

37. Dr. Alan Sager, Boston

University School of Public Health, Response to Rep. Henry A. Waxman

(Aug. 1999).

38. Newsweek, When Pets Pop

Pills (Oct. 11, 1999).

39. Pfizer, Inc., 1998

Annual Report (1999); Los Angeles Times, Animal Drugs Become Big Pet

Project for Industry (Oct. 12, 1999).

40. Pfizer, Inc., 1998

Annual Report (1999).

41. Animal Health Institute,

Testing...testing....testing: Food Safety and Animal Drugs (May

1999).

42. Prescription Drug

Pricing in the 5th Congressional District in Florida: Drug Companies Profit at

the Expense of Older Americans (May 1999), supra note 12.

43. Prescription Drug

Pricing in the 5th Congressional District in Florida: Drug Companies Profit at

the Expense of Older Americans (Mar. 2000), supra note 12.

44. Prescription Drug

Pricing in the 5th Congressional District in Florida: An International Price

Comparison, supra note 13.

45. The manufacturer-level

price for thirty 0.125 mg Lanoxin tablets is $5.10. These 30 tablets contain a

total of 3.75 grams of active ingredient. The liquid version of the product

contains 3 grams of active ingredient. In order to obtain a direct comparison of

prices for these products, the analysis determined the cost of 3 grams of active

ingredient in the tablet form. This cost, which is the price used in Table 1 in

the text, is (3/3.75) *($5.10) = $4.08.

Return to

the Prescription Drug Study