|

|

Part 1 ~ How can USPS thrive in the 21st century?

Part 2 ~ net change: How the challenges of electronic commerce stack up for USPS

Part 4 ~ Commercial Freedom: Is USPS being left behind as ost offices abroad go global?

Part 5 ~ Creating a Postal Service to serve America's future

|

|

market wars:.Postal Service rivals clamber for position in the new e-commerce economy |

|

|

. |

Delivering the promise of Internet commerce

Postal Service, UPS, FedEx vie for piece of e-commerce pie

There is no such thing as virtual delivery. That was the lesson learned at the end of 1999, which in the nation’s millennial fever became known as the first holiday shopping season of the Internet Age. The December hype of booming dot-com sales gave way to January’s harsh realities: It is far easier to put up web sites for point-and-click consumers than it is to fulfill and deliver orders.

Many new e-tailers, including some rather big ones like Toys-r-us.com, discovered they did not have the capacity to meet holiday Internet orders and found it difficult to get their goods delivered on time. Others, such as Amazon.com, which uses the Postal Service’s Priority Mail service to deliver nearly two-thirds of its book and CD orders, performed much better.

So the race is on to build capacity and perfect delivery mechanisms before the next holiday season. And the multitude of online retailers are not the only ones racing—the Postal Service and its private sector rivals are vying to capture delivery work associated with e-commerce.

Although Internet sales to consumers comprised less than one percent of total retail sales in the fourth quarter of 1999 (at $5.3 billion), the outlook for future growth is outstanding. Some 41 million Americans are expected to purchase something online this year, according to Forrester Research, a leading analyst of the technology industry.

PriceWaterhouseCoopers predicts online sales to households will rise from $18 billion last year to $108 billion in 2003. More important for the USPS and its competitors, the giant accounting firm expects delivery charges on these sales to rise from $1.1 to $8.7 billion over the same period (see chart).

The stakes could not be higher for letter carriers and the USPS. As the Internet diverts billions of pieces of letter mail from the Postal Service, generating new business will be vital to preserving America’s universal postal system. Delivering online merchandise to American households is one of the more promising areas of new business for the USPS. Standing in the way, of course, are two of America’s best-known and well-respected companies: United Parcel Service (UPS) and Federal Express (FedEx).

BATTLE OF THE TITANS

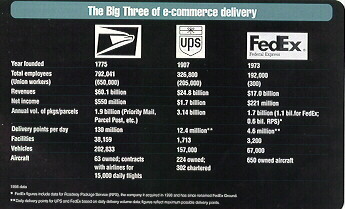

The three national delivery companies currently divvy up more than $100 billion in annual revenues and employ more than 1.3 million workers in what might loosely be defined as the postal, express courier and shipping business.

As the table on page 11 indicates, the Postal Service is the oldest and largest of the “Big Three.” But UPS and FedEx are multinational corporations with global reach and impressive financial strength. So the battle is truly one of titans.

There are, of course, other important players in the market, including Airborne Express and DHL, companies with which the USPS has initiated important partnerships over the past year. But the USPS, UPS and FedEx are best positioned to cash in on the online future.

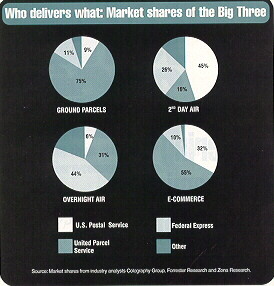

While the Postal Service has areas of strength, it also has some notable weaknesses. UPS dominates the delivery of ordinary parcels, most of which are sent from business to business and are shipped by ground transportation. FedEx is the market leader in the delivery of express documents and parcels, which are transported by aircraft for overnight delivery.

The Postal Service’s competitive advantage lies in the provision of so-called deferred air deliveries, sometimes referred to as second-day air (see chart). Most of these deliveries are Priority Mail, which is processed at two USPS-operated airport hubs and a third network operated on the East Coast under contract by Emery Worldwide, a private transport and logistics company.

Atlanta-based United Parcel Service has grabbed the early lead in the race for residential deliveries of e-commerce sales. The company is believed to have delivered 55 percent of the goods sold via the Internet in 1999. This compares to the Postal Service’s market share of 32 percent and FedEx’s share of 10 percent. But it is too early to tell what will happen in the future.

“The jury is still out on who is going to win the game,” noted Theodore Scherck, president of the Colography Group research firm. “Perhaps [it will be] somebody other than the dominant player today.” The dominant player today, of course, is United Parcel Service.

UPS

Big Brown's e-commerce juggernaut

If Americans in general, and letter carriers in particular, did not appreciate the pervasive role UPS plays in the U.S. economy before its drivers went on strike, they learned soon after. When the Teamsters union walked out in August 1997 over excessive part-time work and pension concerns, thousands of large and small American businesses were paralyzed and the Postal Service faced a flood of new parcel business.

With its massive air and ground transport capacity and sophisticated technology for managing complex logistics for companies that have adopted just-in-time manufacturing processes and inventory control systems, UPS has become an indispensable part of the country’s economic infrastructure. Big Brown, as the company is known (for the color of its trucks), handles 75 percent of the regular (non-express) parcel traffic in America. That it often uses hardball tactics against competitors (as discussed below) and abuses the power of its near-monopoly does not change this fact.

DOMINATES IN PARCEL DELIVERY

UPS 's Logistics subsidiary has a deal with Ford to manage delivery of the automaker's entire inventory of vehicles from factory to dealer.

The Postal Service’s superior performance during the strike prompted many UPS customers to give the USPS a modestly growing share of their parcel business, but Big Brown remains the dominant provider in the parcels market:

- It delivers more than 12.4 million parcels a day, far more than USPS’s 950,000 parcels (a figure which excludes Priority Mail).

- It delivered more than 675 million parcels to American homes last year, which represented just 20 percent of the firm’s volume (the other 80 percent is business-to-business traffic).

- It has corporate accounts with more than 1.6 million customers who get scheduled pickups on a daily basis.

- It has invaded FedEx’s turf and expanded into overnight delivery service with a fleet of 525 owned and leased airplanes, grabbing nearly a third of that market.

- It has invested more than $10 billion over the past five years in information technology. UPS drivers now use wireless digital scanners to record deliveries and to instantly capture signatures confirming receipt of packages. These devices allow customers to track packages in real time either by phone or the Internet and permits UPS to offer guaranteed pickups within 30 minutes by maintaining constant contact between drivers and dispatchers.

- It has begun to market its “supply chain management systems” to corporate customers. These systems tie just-in-time manufacturing processes and inventory control systems into UPS’s delivery network. For example, the company’s UPS Logistics subsidiary recently signed a deal with Ford Motor Company to manage the delivery of the automaker’s entire inventory of vehicles from factory to dealer.

- It has deployed a new joint venture with Hewlett-Packard called UPS Document Exchange, which allows customers to digitally scan and electronically send paper documents in a secure, tamper-proof way over the Internet.

- It has aggressively expanded its operations all over the globe, with service to more than 200 countries and UPS personnel and facilities in most of them. End-to-end control of deliveries is the norm for UPS. (The Postal Service, on the other hand, must depend on other countries’ public post offices to complete deliveries abroad.)

United Parcel Service’s business success has translated into huge profits ($2.3 billion in 1999) and tremendous financial strength. UPS capitalized on this strength last November when the privately held company launched the largest initial public offering (IPO) in American history, selling 10 percent of the shares in the company to the public for $5.5 billion. Employees owning stock in the company saw the value of their holdings more than double in one day.

The proceeds of the IPO are to be used to acquire technology companies that can assist UPS’s development in the future. For starters, UPS helped develop iShip.com, a Seattle-based software company specializing in shipping analysis programs. Ironically, iShip.com was purchased in March by Stamps.com, the online postage vendor with ties to former Postmaster General Marvin Runyon.

RESIDENTIAL MARKET STRATEGY

UPS is well-placed to capture a large percentage of business-to-household e-commerce because it already dominates the much larger business-to-business e-commerce market. (That market is expected to grow to more than $1.5 trillion in sales over the next five years.)

UPS’s strategy is to become a full-service vendor, offering a wide range of services to manage the flow of information, goods and funds between a retailer and its customers. It plans to achieve this through huge new investments in information technology and increased retail capacity.

On the technology front, UPS has developed a software program that allows retailers to integrate ordering, shipping, tracking and payment services with retailer web sites. Another program, UPS Online Tools, is geared toward professionals and small business owners. And a new UPS-sponsored venture capital fund will invest and bring to market new technology firms that can enhance its information-managing capabilities.

In February, UPS announced it would test a network of 12 to 15 UPS Pack and Ship stores across the country over the next three years. The stores will sell office supplies, provide fax and copy services and accept parcels for delivery via UPS. If this business model sounds familiar, it is—it resembles the Pack and Send service the USPS attempted to launch a few years ago.

Pack and Send was scuttled in part by the political action of UPS and its allies in the “private post office” business. Complaining of “unfair competition” from the government, UPS and chains like Mail Boxes Etc. USA mobilized opposition to Pack and Send in Congress and at the Postal Rate Commission. Ironically, Mail Boxes Etc. and other erstwhile allies of UPS are now howling that Big Brown is threatening their future with its Pack and Ship stores.

In short, UPS plans to use its existing advantages in technology and its existing integrated network of air and ground transport to cash in on the home delivery boom created by the Internet. Although it might prove foolish to bet against UPS’s success, its main private sector rival is taking a quite different approach.

FedEx

Federal Express reinvents itself

for the Internet age

Letter carriers and other postal employees might have a hard time mustering any real sympathy for the plight of Federal Express. After all, it was the Memphis-based FedEx that built its business in the 1970s with television ads unfairly attacking “slow, lazy” postal workers and, in 1978, bullied the USPS into administratively relaxing the Private Express Statutes to permit overnight delivery of “urgent letters.” Moreover, its legendary chairman and CEO, Frederick Smith, recently called for winding down the Postal Service in the face of the revolution in information technology.

Yet in many ways, FedEx is even more vulnerable to that revolution than the Postal Service is. The Internet is eroding the market for overnight documents at a much faster rate than it is for ordinary first-class mail. Moreover, sophisticated software is permitting businesses to better manage their inventories and reduce the need for expensive urgent shipments at the same time that USPS Priority Mail service is increasingly seen as a better value than costly overnight service.

If that weren’t bad enough, secure Internet transmission of documents threatens to eliminate even more of FedEx’s core business. Indeed, UPS predicts its Document Exchange service, offered in partnership with Silicon Valley’s Hewlett-Packard, will siphon off 35 percent of air express volume by 2003.

Of course, letter carriers need shed no tears for FedEx. It is a fiercely competitive firm with tremendous resources and numerous advantages. It would be foolhardy to underestimate the ability of FedEx to adapt to the challenges posed by the Internet. It has a long history of technological innovation—it was the first company to equip its delivery personnel with scanners and the first to permit its customers to track packages online, for example—and it is moving at lightning speed to reinvent itself.

EYE ON THE PARCEL PRIZE

In many ways, Federal Express has taken a page from the UPS play book. Just as UPS invaded FedEx’s turf on overnight documents, FedEx ventured into the ground parcel market in 1998 when it acquired the Roadway Package Service company from Caliber Inc. RPS, whose non-union delivery personnel specialized in business-to-business parcel delivery, used its lower prices to eat into UPS’s stranglehold on the delivery of ground parcels and boosted its share of the market from almost nothing in 1985 to 11 percent in 1998. Over the past two years, FedEx has invested more than $500 million to double RPS’s capacity.

FedEx has also invested heavily in information technology. It has upgraded its wireless communications to match those of UPS and has developed Internet-commerce software for businesses large and small. The FedEx web site features a MarketPlace with links to companies such as L.L.Bean and (ironically enough) HP.com, the online retail site of UPS’s partner in Document Exchange, Hewlett-Packard. These links generate demand for FedEx’s delivery services.

Finally, FedEx has also worked to expand its international business, especially the booming trade in computer hardware and microchips. Like UPS, FedEx has begun to market itself as an inventory and logistics service for companies.

For instance, Cisco Systems, the company that makes the hardware that underpins most of the world’s web servers (computers that are the backbone of the Internet), announced earlier this year that FedEx will manage its entire logistics network, with the goal of completely eliminating Cisco’s warehouses in Asia. Instead, the two companies aim to create a “flying warehouse” with FedEx delivering component parts directly to customer facilities for final assembly.

RESIDENTIAL MARKET STRATEGY

When it comes to serving the residential market, where it competes with the Postal Service most directly, FedEx is taking a much different approach than UPS. Instead of integrating its business-to-business and business-to-household services in the way UPS has, FedEx has decided to launch a dedicated residential delivery service. With low-cost non-union labor, this new service may pose a more serious long-term danger to the Postal Service than the parcel trucks of Big Brown.

FedEx has a long history of technological innovation and it is moving at lightning speed to reinvent itself.

The company unveiled its strategy in March, officially renaming itself FedEx Corporation and reorganizing into three major business units. The core business of overnight air delivery is known as FedEx Express. RPS was recast as FedEx Ground, the company’s ground parcel service aimed at the business-to-business market. And FedEx Home Delivery, a unit of FedEx Ground, was launched to serve the residential market. The three units will share technology and merge certain administrative functions such as marketing and billing but will otherwise be autonomous with separate facilities, vehicles and operations.

FedEx Home Delivery was launched in March with just 500 workers who have been hired as “owner-operators.” As such they must provide their own vans and will be paid on the basis of the volume they deliver. That arrangement, which serves to prevent unionization, will keep costs very low compared to UPS and perhaps even to the USPS.

Postal Service embraces e-payments

The Postal Service launched its own Internet-based electronic billing and payment service April 5, staking a claim to a service that threatens to slice into first-class mail revenues. In kicking off the program USPS used the pitch, “No stamps to buy or envelopes to address.”

The announcement came just days after NALC members began receiving the April Postal Record with its cover story on the impact of electronic commerce on the Postal Service.

The new “USPSeBillPay” is being offered through CheckFree Corp., one of the leaders in e-payments, and YourAccounts.com. The Postal Service is emphasizing its position as a trusted third party and universal service provider.

USPSeBillPay is free for the first six months. After that the charge will be $6 per month for 20 monthly payments, with a 40 cent charge for each additional bill. A pay-as-you-go option will cost just $2 per month, and charge 40 cents per payment.

Details are available—where else?—on the Postal Service website.

FedEx Home Delivery is now operating 67 residential delivery depots in 40 metropolitan areas and claims to reach 50 percent of the nation’s households. But its plans call for another 240 depots to serve 98 percent of the population within three years. Its approach to the business reflects FedEx’s history of innovation—it will deliver Tuesdays through Saturdays, with late afternoon to early evening delivery when people are most likely to be home. It will also offer guaranteed, date-specific delivery in anywhere from one to five days for an extra charge and will schedule parcel pickups as late as 9 p.m.

The official logo of FedEx Home Delivery features a sweet, harmless looking puppy. But as letter carriers used to dealing with dogs know, looks can be deceiving. The competitive threat posed by FedEx Home Delivery to the Postal Service’s plans to cash in on the unfolding Internet shopping boom is a severe one. Letter carriers should not underestimate it.

POSTAL SERVICE'S COMPETITIVE POSITION

According to Postmaster General William Henderson, the USPS is delivering about a third of all goods purchased on the Internet. Many observers have been surprised by the Postal Service’s strength in this market segment. It should come as no surprise, though. After all, the Postal Service has been delivering “mail order” goods to households for more than a century.

While UPS and FedEx deliver to at most two to three million homes per day, the USPS reaches each one of the country’s 130 million addresses six days a week. The “economies of scope” available to the Postal Service—through which the additional cost of delivering a parcel is minimized if letter carriers are already visiting a home to deliver letter mail, catalogs and magazines—make it the low-cost provider in most cases of residential delivery.

The Postal Service has had notable success with some of the more prominent e-commerce companies, including Amazon.com and eBay. Amazon’s Jeff Bezos, founder and CEO of the online seller of books, CDs, electronics and toys, says his company uses a computer program to calculate the best combination of cost and speed of delivery—“and 65 percent of the time that [program] chooses U.S. Postal Service Priority Mail.”

Tom Adams of eBay, the online auction company that has grown exponentially in recent years, credits the Postal Service for the success of his company.

As described in Part Two of this series, the USPS has initiated numerous efforts to build on its e-commerce success. It is making it easier for customers to return online goods through its Return@Ease and Bulk Parcel Return Service programs. It has created rate incentives for bulk parcel consolidators to drop-ship volume to delivery units. And it has entered into strategic partnerships with Airborne Express for residential delivery in the United States and with DHL for international delivery services.

But as the corporate profiles sketched here indicate, the private companies have tremendous advantages in the e-commerce market. Wall Street analysts cite a huge edge in the area of technology and managerial talent for FedEx and UPS. But their real strength is more structural—the Postal Service does not have the commercial freedom enjoyed by its competitors, since rates and services are set by the Postal Rate Commission. So the USPS is prohibited from negotiating service and pricing arrangements with corporate and other large-volume customers that differ from those available to any other customer.

In the short run, the USPS must emulate the most innovative practices of the private sector firms. But the long-term survival of the Service will require reform legislation to give the USPS the ability to take full advantage of the opportunities presented by the Internet. Unfortunately, the Postal Service’s private sector competitors are not about to lie down and give up. They are fighting any efforts by the Postal Service to adapt to the technological circumstances facing us in the 21st century.

Postal Service rivals attack on three fronts

While the Postal Service’s private sector rivals are adapting their business plans and operations to fit the new economy, they are simultaneously waging a three-front campaign against USPS to freeze it out of some markets and hamstring its attempts to grow in the future.

To an unprecedented degree, today’s challenges to the survival of the Service are arising directly from commercial competitors, rather than the political ideologues who have championed privatization for the past quarter century.

Nonetheless, the assault features a major political component and is fueled by millions of dollars of direct lobbying and contributions to candidates. From the chambers of state legislatures to the halls of Congress and on into the world marketplace, the Postal Service is being portrayed as an “out of control,” anti-competitive, over-priced and abusive government bureaucracy that must be reined back, dismembered or dismantled.

These attacks ignore several simple truths—the USPS operates in a regulatory straightjacket that inhibits innovation and exposes its inner working to competitors; far from hogging lucrative business, it serves the remote and unprofitable with equal devotion in order to fulfill its universal service mandate; and it provides every business and household with dependable delivery services for a far cheaper rate than any postal authority—or private firm—in the developed world.

Facts, however, rarely get in the way of these dollars-and-cents-driven attacks. The onslaught has escalated over the past two years with United Parcel Service leading the charge. Other express carriers have taken their swings as well, and new e-commerce-based delivery services are eagerly piling on, but UPS—the Big Brown of the package industry—clearly relishes the role of No. 1 post office basher.

To assess how these rivals are attacking, let’s look at three areas—the campaign in Congress to deform or derail postal reform legislation, efforts to promote that agenda by whipping up a phony “grassroots” movement against USPS in state legislatures, and a series of forays onto the global stage, all aimed at thwarting Postal Service growth and innovation.

OFFENSIVE BEFORE CONGRESS

It was 14 months ago—last March 4—when Jim Kelly, the CEO of UPS, told the House Postal Service subcommittee that as part of postal reform legislation Congress should ban USPS from entering any “competitive” area. Kelly’s argument—echoed by other delivery business leaders and their political allies—is that where “free enterprise” offers a service to citizens, the Postal Service should be frozen out. USPS should be cut back to its “core” business and eventually be abolished as private companies take over its role.

Legislative guerrilla warfare against USPS makes it imperative that letter carriers get actively involved in this year's congressional and presidential campaigns. Their jobs depend on it.

For Kelly—who sat beside his major private sector rival, FedEx chief Fred Smith—the appearance was another skirmish in the “war” he had declared in April 1998 against the Postal Service. In a speech then before the National Press Club in Washington, Kelly blasted away, branding the Service “an anti-competitive, anti-free enterprise government bureaucracy that wouldn’t last a day in the free and open market of real competition.” (A videotape of portions of that speech were shown later that year to delegates at NALC’s convention in Las Vegas to alert members to the assault.)

The two-year-old offensive has been as relentless as UPS’s drive to shore up profits and recoup market share lost to the Postal Service during the Teamsters’ 15-day strike in 1997. While NALC, the Postal Service, direct marketers and other groups have been working for more than two years with Rep. John McHugh (R-NY) to craft fair and effective postal reform legislation, UPS and other corporate interests have thrown up roadblocks, promoted “poison pills,” and spread misinformation across Capitol Hill—and the entire nation—designed to corrupt the reform effort and undermine the Service.

For instance, last May every member of Congress got a “Big Brown Box” of UPS propaganda, including a packet of clippings, a brochure headlined “A GIANT, Uncontrolled Agency,” and a CD-ROM that begins with a professional announcer ominously warning: “There is a federal agency that is out of control. It ignores Congress. It competes directly and harmfully with private sector business....”

The presentation ends with a plea to impose more “oversight” on USPS—Washington code for putting more limits on, and more bureaucracy in the way of, Postal Service innovation to meet customers’ needs and adaptation to changing markets, like the boom in Internet retailing and electronic bill-paying, and, in short, undermine Subcommittee Chairman McHugh’s reform legislation.

Misinformtion, stealthy legislative attacks and backroom political maneuvering--the tactics underline the determination of Postal Service rivals to cannibalize the USPS and gobble up huge, lucrative chunks of the growing delivery market.

That legislation, known as H.R. 22, has been crafted through extensive hearings and countless hours of negotiations and consultations, horse-trading and arm-twisting—in short, the legislative process. Along the way, the NALC has been a consistent voice for changes that make sense for the American people and for the survival of the Postal Service.

But resistance has been stiff and if the legislation is stymied, USPS faces a double threat. Not only would the Postal Service lose out on possible benefits from a new law (greater pricing flexibility, for instance, and the ability to quickly launch tests of new services), it also would throw open the doors for a myriad of attacks on other legislative fronts.

Without a reform bill to serve as a “clearing house” for postal proposals, it is easier for mischief-making proposals from anti-Postal Service lawmakers like UPS ally Rep. Anne Northup (R-KY) to become law. Virtually any piece of legislation that comes before Congress could end up carrying dangerous or damaging “riders,” like Northup’s bid in 1997 to freeze USPS out of the overseas parcel business, or the measure that reversed more than a century of national policy and put State Department appointees in charge of international postal relations.

Similarly, any new product the Postal Service tries to test could undergo attack by amendment, with private carriers’ political allies trying to tack on language banning each particular service (see sidebar on the new USPS electronic bill-paying program).

That kind of legislative guerrilla warfare makes it imperative that letter carriers get actively involved in this year’s congressional and presidential campaigns. Their jobs depend on it because these threats can be blunted only by electing friends of working families and of a Postal Service that is strong enough to fulfill its universal service mandate.

STATE BATTLEGROUNDS

While Postal Service competitors have made frontal attacks on Capitol Hill recently, they also have pursued a pernicious national program to con state legislatures. This assault aims to foment anti-USPS sentiment by blowing smoke at ill-informed citizen-lawmakers.

Fast facts to counter

competitors' con job

Unlike its private competitors, the Postal Service is required to provide universal service at uniform rates. It does not pick its customers, refuse to serve some neighborhoods and slap surcharges on deliveries to remote areas. It cannot offer volume discounts to big customers—the reason the federal government gave its overnight express business to a private company! When the General Services Administration sought bids for overnight deliveries, it specified that the winning company had to give a discount based on the thousands of “urgent letters” sent out by government offices every workday. That requirement guaranteed the Postal Service had no chance to win—FedEx got the business.

Despite opponents’ claims it has huge tax benefits, USPS pays Social Security and Medicare taxes on employees, contributes to unemployment compensation and injury compensation funds, and pays sales taxes on its purchases. It is exempt from corporate income tax—but as noted on page 19, it makes no profit to pay tax on. All net revenues go to pay down debt or modernize facilities and improve service.

Almost all small postal facilities—tens of thousands of buildings—are leased and the owners pay property taxes and related fees, just like private sector businesses. Far from getting a free ride, those taxes are included in the rent USPS pays. Private industry “forgets” to tell the public that it often enjoys benefits like long-term tax forgiveness and rebates, taxpayer-backed loans, and outright subsidies from local development authorities.

Two-thirds of the more than 36,000 post offices, branches and contract stations nationwide operate at a loss—it costs more to keep them open than the revenue they bring in. No private business would keep 24,000 money-losing retail outlets open for very long. Yet to maintain universal service, USPS absorbs that infrastructure cost as a vital part of its mandate.

In two dozen states over the past year, resolutions have been proposed—and seven were passed—urging Congress to whip the Postal Service into line. Corporate lobbyists have provided the wording and without anyone to contradict the big-business line, unwitting lawmakers have gone along. Fortunately, NALC activists in several states, including California, Illinois, Ohio and New Jersey, have succeed in setting the record straight and stopping the proposals dead in their tracks. (For how you can combat similar attacks on the Postal Service and your job, see below).

The resolution approved by the South Dakota House is typical. It urges Congress to “to prohibit the sale by the Postal Service of...non-monopoly goods and services and prohibit further service offerings and advertisements...in areas where the general public is presently served by private industry.”

It seems hard to believe that leaders of a vast, sparsely populated, mainly rural state would knowingly act to subvert the Postal Service that is so vital to its citizens. After all, a strict reading of that language—or even a loose one—leads directly to the private delivery moguls’ stated goal of putting USPS completely out of business. What kind of “mail” service would a private courier company provide to a grandmother in Grassy Butte, North Dakota, or a grandchild in Uniontown, Alabama, and at what price?

GOING GLOBAL AGAINST USPS

But the attempts to undercut the Postal Service do not stop at the water’s edge. The global economy, increasingly interconnected by electronic means, also is creating greater demand for delivery services. Private competitors are waging an insidious campaign to clip the wings of the postal eagle abroad.

In large part, this international effort is being waged with the same tools of deceit used on domestic policy. The latest salvo featured a widely publicized study conducted for the Air Courier Conference of America (a consortium of private shipping firms) that alleged parcels handled by the Postal Service got preferential treatment from the U.S. Customs Service. The study, released in February, made some dramatic claims—including that Customs’ failure to collect duties owed on international mail parcels may have cost the government $1.5 billion in revenue in one year.

Outrageous—if true. But the study was so flawed that one House member made a joke about it during an oversight hearing in April. Not surprisingly, Rep. Northup was touting the study, but Postmaster General Bill Henderson disputed it effectively and the congresswoman seemed to be alone in giving it credence.

If postal reform legislation is stymied, USPS faces a double threat. Not only would it lose out on possible benefits, it could face a myriad of attacks on other legislative fronts.

The basic flaw was in multiplying a skewed and statistically dubious sample to achieve the pre-determined result of putting the Postal Service in a bad light.

According to Customs, express carriers handle more than 1.1 billion inbound international shipments each year. The Postal Service handles less than one-one hundredth as many—around 11 million. Yet the ACCA “study” results were based on a test of two sets of 90 expedited packages—one set sent by UPS and FedEx, the other through foreign postal authorities to the USPS for final delivery.

Each set of test packages included equal quantities of “dutiable” items—ball bearings or silk shirts, for instance—and some of those sent by mail “slipped through.” But extrapolating that to all postal packages is preposterous—commercial shipments by private courier are much more likely to be dutiable than postal parcels, which are usually personal or not subject to duties, like documents, gifts or souvenirs, or items worth less than $200.

And, even if the ratio of packages Customs failed to collect duties on were as high as claimed, it would take at least 30 million shipments, nearly four times current volume, to reach the $1.5 billion figure. The result obviously was inflated to paint the worst possible picture of the Postal Service.

v

It seems hard to believe that leaders of a vast, mainly rural state would knowingly act to subvert the Postal Service. What kind of "mail" service would a private courier company provide to a grandmother in Grassy Butte, ND, or a grandchild in Uniontown, AL, and at what price?

The Customs angle is simply the latest twist. Rep. Northup—whose district includes a major UPS hub facility—tried but failed in the last Congress to pull the plug on Global Package Link, a USPS program to build its international shipping product, which now includes fast-growing Global Priority Mail. During her short tenure in Congress, Northup has succeeded in demoting the Postal Service’s position before the Universal Postal Union, the international body that coordinates mail around the world, including setting “terminal dues” payments that postal authorities pay one another for delivering each other’s mail.

Under a provision she championed, the State Department is designated as the leader of the U.S. delegation to the UPU. The Postal Service, while it provides the lion’s share of expertise, is considered simply a member of the group—a group that includes UPS and FedEx as equal partners. No other country has private carriers in its delegation, and postal officials from around the world have expressed shock that commercial couriers’ ambition to dominate international markets is moving up on the U.S. agenda.

These few examples of the tactics being used against the Postal Service—misinformation, stealthy legislative attacks and backroom political maneuvering—underline the determination of its rivals to cannibalize the USPS and gobble up huge, lucrative chunks of the growing delivery market. This bid to box in the Service, to smother it with regulatory limits or to starve it by cutting off crucial new sources of revenue, is heating up. Coupled with the changes being wrought by the Internet revolution, the competitors’ campaign forms a pincer closing on the Service.

Front line of service, first line of defense

Letter carriers can help quell anti-USPS campaign

Long considered the front line of the Postal Service in their daily contact with patrons, letter carriers can also be instrumental in squelching the exaggerations and outright falsehoods being perpetrated by USPS competitors on Capitol Hill, before state legislatures, and to the general public.

Spreading truth and understanding begins at the grassroots. Here are some of the facts and arguments compiled by NALC’s Political and Legislative Department and The Postal Record that you can use when you hear phony attacks on the Service for its “monopoly abuses” and “non-postal” business:

FACT: USPS provides affordable service that private “cherry picking” companies won’t.

While competitors lambaste the postal “monopoly” on letter mail and allege a 33-cent stamp costs too much, none of them claim they would replace the service it ensures—reaching every address every day, both delivering and picking up letters and parcels, without discriminating among inner-city, suburban or rural customers.

While the Postal Service’s rates are regulated and by law must be affordable for everyone, private companies routinely raise rates to boost profits—UPS raised its rates between 3 percent and 5 percent each year from 1995 through 1998 while boosting profits by nearly 70 percent. The January 1999 postage rate increase—the first in five years—averaged just 2.9 percent for all classes of mail; the added penny for a first-class stamp amounted to only 1.7 percent.

FACT: USPS does not make a “profit.”

In most of the years since postal reorganization in 1971, the Postal Service piled up debt—both from operations and being required to fork over billions of dollars to Congress to help cover federal deficits. The heavily publicized net income generated in recent years has gone mainly to pay down USPS debt (still $6.9 billion at the end of fiscal 1999) and to strengthen the infrastructure needed to meet the universal service mandate—physical plant, automation equipment and transportation.

FACT: “Non-postal” products don’t compete with the private sector.

There’s no denying that USPS sells stamp-art collectibles, including novelty and commemorative stamps and albums, to generate extra revenue, but since the Postal Service is the exclusive owner of stamp art, there is no direct competition with the private sector. And, the extra revenue from such programs helps to cover the costs of universal service and to keep postage rates down. Other offerings, such as padded envelopes and mailing boxes, are sold as a convenience to customers, many of whom would find it difficult or impossible to obtain these services elsewhere.

FACT: First-class mail revenue does not subsidize other products.

The congressional General Accounting Office, the Postal Rate Commission, and the Postal Service Inspector General have all investigated charges that “monopoly” revenues from first-class letters are used to keep prices of other services artificially low, forcing competitors in the delivery business to set unrealistically low prices. Every one of these investigations have concluded that this is not the case. There is no “cross-subsidization.”

FACT: The Postal Service is accountable, not “out of control.”

The bi-partisan USPS Board of Governors, appointed by the president and confirmed by the Senate, directs all Postal Service operations. Several committees in the House and Senate are charged with oversight of the Postal Service and hold dozens of public hearings every year to hear USPS critics and question its officers. USPS borrowing and investing practices are overseen by the Treasury Department. Unlike private sector competitors, the USPS has a public rate-setting process, in which it must convince the independent Postal Rate Commission that its new rate schedule is fair and “breaks even.”

Other articles in the Postal e-volution series:

Part 5 - Creating a Postal Service to serve America's future |

In the June issue: Commercial Freedom: Is USPS being left behind as post offices abroad go global? |

|

|

© copyright, National Association of Letter Carriers, all rights reserved.

|

|

Return to NALC homepage , What's New; The Postal Record or NALC Publications.

This page was last updated July 7, 2000.

If you have questions or comments about technical aspects of the NALC homepage, please write to the National Association of Letter Carriers at 100 Indiana Ave., NW, Washington, D.C. 20001-2144 or send e-mail to nalcinf@nalc.org.

Please direct all other comments or inquiries in writing to the National Association of Letter Carriers at 100 Indiana Avenue, NW, Washington, D.C. 20001-2144 -- see the bottom of the NALC homepage for more specific information .