|

Some of the reasons why Death Tax repeal momentum is peaking: |

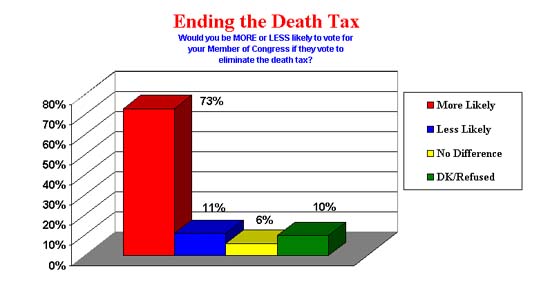

1. POPULARITY. A new poll for the year 2000 commissioned by the Polling Company showed that 73% of Americans favor repeal of the Death Tax and a similar number said they would be more likely to vote for a member of Congress who favors repeal. Even the most cynical member of Congress has trouble resisting those numbers. As Martin says, “Those who vote against the Death Tax repeal, do so at their own peril.” The graph below illustrates that point!

Survey by the polling company for the 60 Plus Association/ January 2000

|

2. LEADERSHIP. The Congressional Leadership is united behind the issue of repealing the Death Tax. Speaker of the House Denny Hastert [ receiving the Benjamin Franklin Award from Martin and Zion] has long been a proponent of Death Tax repeal and even campaigned on repeal during the last elections cycle. Furthermore, the official Republican response to the President’s State of the Union included Death Tax repeal as a top priority. |

3. BIPARTISAN SUPPORT. Unlike many proposals in Washington these days, Death Tax repeal enjoys wide spread appeal from across the political spectrum. On the Republican side support ranges from conservatives such as Representative Bob Barr (GA) to moderates such as Representative Sue Kelly (NY). On the Democratic side, support ranges from conservative Representative Ralph Hall (TX) to moderate leader of the Democrat Blue Dogs Representative Bud Cramer (AL) all the way to liberals such as Representative Nick Rahall (WV). Even liberal scholars who believe in social redistribution have come to the conclusion that the Death Tax fails and may exasperate the difference between rich and poor because it makes the rich spend more. As former Chairman of President Clinton’s Council of Economic Advisers, Joesph Stiglitz, wrote in the Journal of Political Economy: “The desirability of estate [Death] tax may still be questioned, not only because of the distortions it introduces but also because it may increase inequality in the distribution of consumption.”

4. BUDGET. In a stunning new

report, Joint Economic Committee (JEC) of Congress detailed that not

only is the Death Tax incredible harmful to the public, it is also of no

help to the federal government. In a December 1998 study the JEC

concluded: “The enormous compliance costs associated with the estate

[Death] tax are of the same magnitude as the tax’s revenue yield, or about

$23 billion in 1998.” 60 Plus Chairman and former Indiana

Congressman Roger Zion commented: “Only the federal government could

collect $23 billion and not have anything to show for it!”

4. BUDGET. In a stunning new

report, Joint Economic Committee (JEC) of Congress detailed that not

only is the Death Tax incredible harmful to the public, it is also of no

help to the federal government. In a December 1998 study the JEC

concluded: “The enormous compliance costs associated with the estate

[Death] tax are of the same magnitude as the tax’s revenue yield, or about

$23 billion in 1998.” 60 Plus Chairman and former Indiana

Congressman Roger Zion commented: “Only the federal government could

collect $23 billion and not have anything to show for it!”

| 5. OUTLIVED ITS USEFUL PURPOSE. The federal Death Tax was passed four separate times to fund military buildups or wars. The first three times – 1797, 1862, and 1898 – it was repealed within 8 years. However, in 1916, the death tax was again enacted to support a war, this time World War One, and it has never been repealed. “The time has come to repeal a tax passed for a war that ended over 80 years ago!” stated Martin. |

6. GRASSROOTS. 60 Plus President Jim Martin has toured the country speaking about the Death Tax. “The Death Tax, or its state versions, the inheritance tax, is causing a great deal of upheaval everywhere. For example, in North Carolina two years ago, the State Assembly wouldn’t adjourn until some movement was made on North Carolina’s Death Tax. As a result of my travels, I am confident that any state that puts Death Tax repeal on the ballot would have a sure fire winner,” Martin said. For example, when California put death tax repeal to a vote, 65% of Californians voted to repeal their inheritance tax.

7. A TAX CUT FOR THE RICH? To this oft made charge Jim Martin, a former U.S. Marine states: “Dismount that horse is dead. The rich don’t pay the Death Tax but instead have accountants, lawyers, and insurance agents working to protect their after tax assets.” Even President Clinton’s own former economic advisers agree that the estate tax doesn’t affect the rich. Alicia Munnell – a former deputy Treasury Secretary in President Clinton’s Administration – wrote in the New England Economic Review: “Horizontal and vertical equity considerations have disappeared in the estate and gift tax area; tax liabilities depend on the skill of the estate planner rather than on the capacity to pay.”

8. THE IMMORALITY OF THE DEATH TAX. The Death Tax is a “virtue tax” since it discourages the savings that the Government generally wants to encourage in its other policies (e.g. Roth IRAs, bonds, etc.). University of Southern California Professor Ed McCaffery, a self described “unrequited liberal” wrote in Tax Notes Today: “Our polls and practices show that we like sin taxes, such as on alcohol and cigarettes. The estate [Death] tax is an anti-sin tax, or a virtue tax. It is a tax on work and savings without consumption, on thrift, on long-term savings. There is no reason even a liberal populace need support it.”

Not only are the pro-repeal forces gaining strength but the anti-repeal

forces are losing their philosophical underpinnings. Martin

concluded, “The time to repeal is upon us. Death Tax repeal is no

longer just an anti-tax crusade but it is also a moral crusade.

Death Tax repeal can no longer be called a Republican or conservative idea

but rather it is a bipartisan cause. Death Tax repeal is an idea

whose time has come.”