|

The

tax's impact on farm and ranch families has been at the center of

the Republican call for a phase-out of the death tax in 10 years.

Montana rancher Lynn Cornwell drove the bill via tractor to the

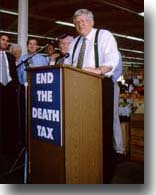

White House on Aug. 24 while House Speaker Dennis Hastert (R-Ill.)

headed South generate grassroots pressure on the president at a

farmers market in Columbia, S.C.

The

original legislation passed the House, 279-136, and the Senate,

59-39. Neither margin exceeds the two-thirds vote required to

override a veto. But the House Republican leadership has predicted

that all members of their party will vote to override the veto--and

that they will gain nine more votes from members that were not

present the day of the original vote. While 65 Democrats supported

the House bill, concern exists over whether those members will now

change their vote.

If

the override is successful, the bill would reduce all estate tax

rates by about 15 percent over 10 years and lower the bottom

effective rate from 37 percent to 18 percent immediately. In 2010,

death taxes would be eliminated and up to $5.6 million of assets

would retain "stepped-up basis." The stepped-up amount would be

indexed to increase automatically at the rate of

inflation.

Farm

Bureau and other estate tax repeal backers have long argued that the

death tax is actually a double taxation that forces family farmers

and small businesses to sell their property to pay Uncle Sam when a

family member dies. The added cost of estate planning is also an

undue burden—especially for farmers dealing with the worst commodity

prices in decades, said Pat Wolff, an American Farm Bureau

Federation senior director of governmental relations.

"The

death tax affects every farmer because 'Joe Farmer' doesn't know

when he's going to die and what his estate is going to be worth when

he dies," said Wolff. "So…farmers are forced to implement estate tax

planning—that takes accountants, attorneys and life insurance.

That's expensive and some farmers just can't afford it."

The

president and many congressional Democrats have criticized the

estate tax repeal legislation as a "budget-busting bill" that

provides a huge tax cut for wealthy Americans at the expense of

working families. Critics also maintain that only about 2 percent of

estates are subject to the tax each year. They offered an

alternative to immediately ease the tax for small businesses, but

keep it on the wealthiest estates.

But

Wolff said that the targeted relief proposal is similar to the

failed family business estate tax exemption Congress passed in 1997.

"It didn't work then and it won't work now," Wolff said. "There were

too many strings attached. Farmers were afraid to use it and

attorneys didn't understand it."

Stallman

said that families of America's farmers and ranchers deserve an

"all-out repeal of the death tax. The death tax is one that

America's farmers and ranchers should not have to live

with." |