|

FOR IMMEDIATE RELEASE:

March 14, 2001

| Contact: |

Meg Mullery |

202.342.8439 |

Specialty Steel Imports in 2000 Set Record

Total Stainless Steel Bar, Rod & Wire

Imports

Captured More than Half of the U.S. Market

(Washington, DC) - Total specialty steel imports in

2000 hit the highest level ever, according to year-end data

released today by the Specialty Steel Industry of North

America (SSINA). Similarly, imports of stainless steel, the

industry's largest product line, reached record highs.

The data reflect that specialty steel imports in 2000

increased 7%, to 894,009 from 834,412 tons in 1999. More than

a quarter of the U.S. market for specialty steel products -

27% -- was lost to these imports.

Paralleling the total specialty steel data, imports of

stainless steel also increased 7% to 692,726 in 2000 from

645,282 tons the previous year, with import penetration

increasing to 27%.

Total imports of all long products, i.e., stainless

steel bar, rod and wire, captured more than half of the U.S.

market - 52%. This was a 7-percentage point increase in import

penetration over 1999, with imports of long products in 2000

at 238,840 tons vs. 177,946 tons in 1999.

"The last decade saw imports soar from 373,148 tons in

1990 to last year's 894,009 tons, a stunning 140% increase.

Most of these imports enter the U.S. market at prices that are

unfair, enjoying excessive subsidization from their home

governments. We believe it is time for strong action, and we

recently developed a plan of action that would help this

modern, efficient and competitive industry combat the record

deluge of unfairly traded imports," said H.L. Kephart, SSINA

Chairman and President and Chief Executive Officer of G.O.

Carlson, Inc., a specialty steel producer in Thorndale,

Pennsylvania.

Kephart was referring to a recommended program that the

industry made public last week which would involve the Office

of the United States Trade Representative, Department of

Commerce, Customs Service, and Congress. He explained,

"Specialty steel producers have been very aggressive and

successful over the last several years in taking targeted

actions against specific foreign producers for dumping and

foreign government subsidies of particular specialty steel

products. The nature and depth of the current import crisis,

however, requires a more comprehensive approach by the U.S.

government. We look forward to working with the Administration

and Congress to implement this plan."

According to the data, while imports of stainless steel

sheet/strip decreased 5%, stainless steel plate imports

increased 9% in 2000 vs. 1999. Imports of stainless steel

plate were 65,622 tons in 2000 compared to 60,305 in 1999.

Import penetration for stainless steel plate increased 2

percentage points in 2000 to 26%.

Stainless rod and bar imports saw increases of 25% and

44%, respectively, in 2000, with rod imports capturing a full

three-quarters of the U.S. market. This 75% import penetration

is a 6 percentage point increase over 1999; stainless bar

imports took a 47% bite out of the U.S. market, a 7 percentage

point increase. Stainless wire imports increased by 26%.

Imports of tool steel increased 6% to 78,629 tons,

reflecting an import penetration of 69% for 2000. Electrical

steel imports increased 7% to 122,654 tons; import penetration

remained the same at 22%.

SSINA is a Washington, DC-based trade association

representing virtually all continental specialty steel

producers. Specialty steels are high technology, high value

stainless and other specialty alloy products. While shipments

of specialty steel account for only 2% of all steel shipped in

North America, annual revenues of approximately $8 billion

account for over 14% of the total value of all steel shipped.

David A. Hartquist, an international trade attorney

with the Washington, D.C. law firm of Collier Shannon Scott,

PLLC, serves as lead counsel to the SSINA.

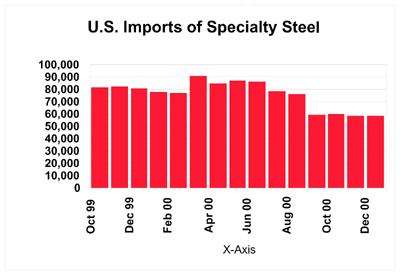

Note: See attached tables for more information on

U.S. imports, consumption and market penetration data; and bar

chart reflecting the 15-month trend of specialty steel imports

between October 1999 and December 2000. Attachment to press

release: Discussion paper entitled "Recommended

Program to Address the Steel Crisis" developed by the

Specialty Steel Industry of North America (SSINA).

U.S. Imports, Consumption and Market Penetration

Data

through 1999 and December 2000

For Specialty Steel

Product Lines

|

MONTHLY AVERAGE |

|

| |

4th Qtr.

'00

(Oct.-Dec.) |

3rd Qtr.

'00

(Jul.-Sep.) |

%

Change

4th Qtr. '00 vs.

3rd Qtr. '00 |

4th Qtr.

'99

(Oct.-Dec.) |

%

Change

4th Qtr. '00 vs.

4th Qtr. '99 |

Current

Month's

Data |

| IMPORTS |

| Stainless Sheet/Strip |

21,461 |

31,193 |

-31.2% |

39,947 |

-46.3% |

21,315 |

| Stainless Plate |

3,034 |

4,656 |

-34.8% |

5,865 |

-48.3% |

3,342 |

| Stainless Bar |

8,732 |

10,357 |

-15.7% |

9,435 |

-7.4% |

8,618 |

| Stainless Rod |

5,515 |

6,857 |

-19.6% |

6,535 |

-15.6% |

4,920 |

| Stainless Wire** |

2,437 |

2,636 |

-7.6% |

2,328 |

4.7% |

2,188 |

| Total Stainless*** |

41,180 |

55,699 |

-26.1% |

64,110 |

-35.8% |

39,383 |

| Tool Steel |

7,301 |

6,249 |

16.8% |

6,003 |

21.6% |

8,738 |

| Electrical Steel |

10,686 |

9,269 |

15.3% |

11,504 |

-7.1% |

10,474 |

| Total Specialty Steel*** |

59,167 |

71,218 |

-16.9% |

81,617 |

-27.5% |

58,595 |

| CONSUMPTION |

| Stainless Sheet/Strip |

127,889 |

149,001 |

-14.2% |

168,522 |

-24.1% |

130,615 |

| Stainless Plate |

16,658 |

18,331 |

-9.1% |

22,410 |

-25.7% |

14,600 |

| Stainless Bar |

19,641 |

21,224 |

-7.5% |

21,084 |

-6.8% |

19,061 |

| Stainless Rod |

7,452 |

8,703 |

-14.4% |

8,974 |

-17.0% |

6,567 |

| Stainless Wire** |

5,980 |

6,051 |

-1.2% |

7,112 |

-15.9% |

5,183 |

| Total Stainless*** |

177,620 |

203,310 |

-12.6% |

228,102 |

-22.1% |

176,027 |

| Tool Steel |

9,719 |

9,177 |

5.9% |

9,258 |

5.0% |

10,956 |

| Electrical Steel |

43,971 |

41,159 |

6.8% |

46,046 |

-4.5% |

40,186 |

| Total Specialty Steel*** |

231,311 |

253,646 |

-8.8% |

283,406 |

-18.4% |

227,169 |

| IMPORT PENETRATION |

| Stainless Sheet/Strip |

16.8% |

20.9% |

-4.2% |

23.7% |

-6.9% |

16.3% |

| Stainless Plate |

18.2% |

25.4% |

-7.2% |

26.2% |

-8.0% |

16.0% |

| Stainless Bar |

44.5% |

48.8% |

-4.3% |

44.7% |

-0.3% |

45.2% |

| Stainless Rod |

74.0% |

78.8% |

-4.8% |

72.8% |

1.2% |

74.9% |

| Stainless Wire** |

40.8% |

43.6% |

-2.8% |

32.7% |

8.0% |

42.2% |

| Total Stainless*** |

23.2% |

27.4% |

-4.2% |

28.1% |

-4.9% |

22.4% |

| Tool Steel |

75.1% |

68.1% |

7.0% |

64.8% |

10.3% |

79.8% |

| Electrical Steel |

24.3% |

22.5% |

1.8% |

25.0% |

-0.7% |

26.1% |

| Total Specialty Steel*** |

25.6% |

28.1% |

-2.5% |

28.8% |

-3.2% |

25.8% |

| NOTE: |

Changes in import penetration are percentage

point changes. |

| * |

Imports adjusted to exclude hot bands imported

for re-rolling and reported under shipments.

|

| ** |

Shipments for 2000 estimated and subject to

revision when actual data is received. |

| *** |

Shipment and consumption data for these

categories may be overstated due to the inclusion of

shipments from wire redrawers which are aready included

in shipments/imports of rod; consequently import

penetration may be slightly understated.

|

Prepared by Georgetown Economic Services for the

Specialty Steel Industry of North America

U.S. Imports, Consumption and Market Penetration

Data*

For Specialty Steel Product Lines

2000/1999/1998

|

Imports |

U.S. Consumption |

Twelve Month

Import Penetration

|

Specialty Steel

Product

Lines |

Month

Dec.

2000 |

YTD

Dec.

2000 |

Percent

Increase/

Decrease |

YTD

Dec.

2000 |

Percent

Increase/

Decrease |

YTD

Dec.

2000 |

YTD

Dec.

1999 |

| Stainless Sheet/Strip |

21,315 |

388,263 |

-5% |

1,875,208 |

-1% |

21% |

21% |

| Stainless Plate |

2,342 |

65,622 |

9% |

252,076 |

1% |

26% |

24% |

| Stainless Bar |

8,618 |

125,725 |

44% |

267,115 |

22% |

47% |

40% |

| Stainless Rod |

4,920 |

82,056 |

25% |

108,910 |

15% |

75% |

69% |

| Stainless Wire** |

2,188 |

31,059 |

26% |

83,032 |

-2% |

37% |

29% |

Total Stainless Steel***

(Sheet, Strip,

Plate, Bar, Rod & Wire) |

39,383 |

692,726 |

7% |

2,586,341 |

2% |

27% |

25% |

| Tool Steel |

8,738 |

78,629 |

6% |

114,226 |

1% |

69% |

65% |

| Electrical Steel |

10,474 |

122,654 |

7% |

564,474 |

10% |

22% |

22% |

| Total Specialty |

58,595 |

894,009 |

7% |

3,265,041 |

3% |

27% |

26% |

1999 and 1998 statistical data in tons

follow:

|

Imports |

U.S. Consumption

|

Twelve Month

Import Penetration

|

Specialty Steel

Product

Lines |

1999

|

Percent

Increase/

Decrease |

1999

|

Percent

Increase/

Decrease |

1999

|

1998

|

| Stainless Sheet/Strip |

407,032 |

-2% |

1,896,918 |

4% |

21% |

23% |

| Stainless Plate |

60,304 |

7% |

249,955 |

-6% |

24% |

21% |

| Stainless Bar |

87,537 |

-7% |

219,156 |

-8% |

40% |

40% |

| Stainless Rod |

65,672 |

6% |

94,783 |

5% |

69% |

69% |

| Stainless Wire** |

24,738 |

-19% |

85,113 |

-7% |

29% |

33% |

Total Stainless Steel***

(Sheet, Strip,

Plate, Bar, Rod & Wire) |

645,282 |

-2% |

2,545,924 |

2% |

25% |

26% |

| Tool Steel |

74,117 |

9% |

113,431 |

5% |

65% |

63% |

| Electrical Steel |

115,012 |

-8% |

512,062 |

-1% |

22% |

24% |

| Total Specialty |

834,412 |

-2% |

3,171,417 |

1% |

26% |

27% |

|

| NOTE: |

Changes in import penetration are percentage

point changes. |

| * |

Imports adjusted to exclude hot bands imported

for re-rolling and reported under shipments.

|

| ** |

Shipments for 2000 estimated and subject to

revision when actual data is received. |

| *** |

Shipment and consumption data for these

categories may be overstated due to inclusion of

shipments from wire redrawers which are aready included

in shipments/imports of rod; consequently import

penetration may be slightly understated.

|

Prepared by Georgetown Economic Services for the

Specialty Steel Industry of North America

|